First some basics.

What is a bear market?

A stock market decline exceeding 20% is a common threshold for a “bear market designation”.

How long does a bear market last?

Investor experiences following these declines have been anything but uniform. In some cases, the market continued its descent past 20%, while at other times the losses topped out soon after crossing the -20% line.

What should an investor do in a bear market?

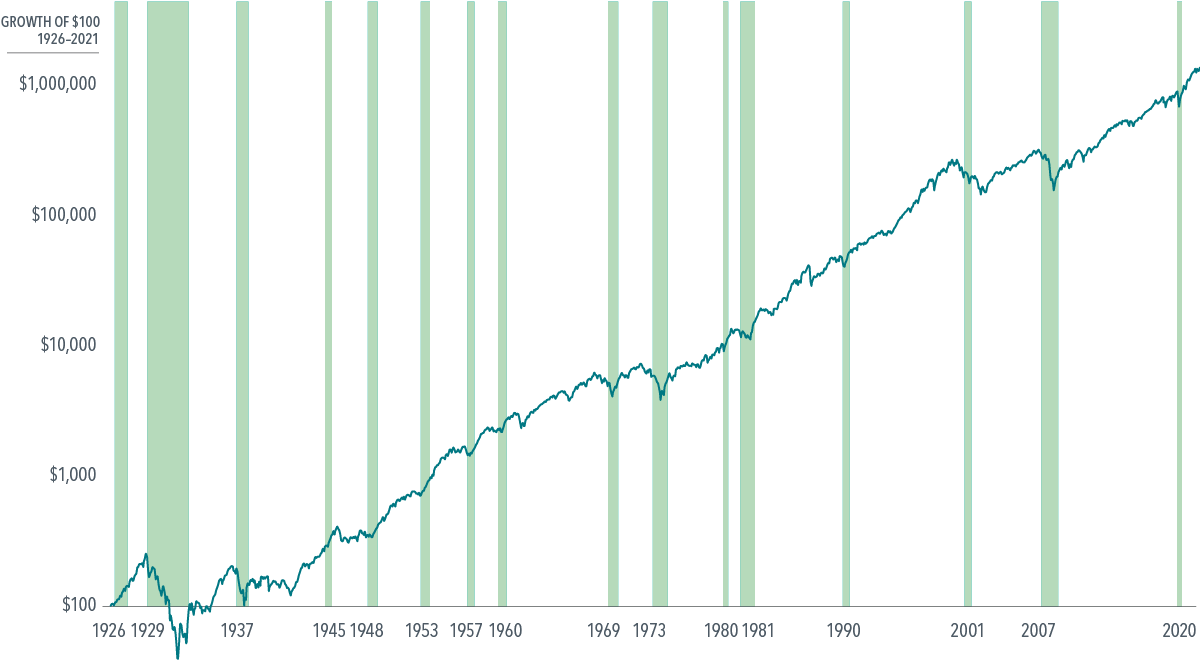

Historically, it has generally benefited investors to remain in the market, as the recovery to pre-decline levels was often swift – investors were made whole within a year in nine of the 15 bear markets since 1929 (shown in the chart below).

When does it make sense to de-risk or reduce stock market exposure in your portfolio?

I believe the only good reason to sell out of a stock portfolio now – assuming it is a diversified low cost portfolio – is because you learned something about your risk tolerance or your investment goals have changed. If you do take risk out of your portfolio, it should be a strategic long-term allocation plan based on this realisation, not a tactical (timing) choice.

Reminding ourselves that investing is a long-term strategy, as opposed to short-term strategies, like trading, speculating, and gambling helps us avoid devoting too much focus on the present. Over 1, 3, 5+ year periods, stock market returns are generally pretty robust after a bear market (shown in the chart below).

A Recession is Not a Reason to Sell

One of the best predictors of the economy is the stock market itself. Markets tend to fall in advance of recessions and start climbing earlier than the economy does. As the chart below shows, returns have often been positive while the economy was still in a recession.

The green vertical bars show the length of the recession, while the blue line shows the performance of the stock market.

For more info about each of these recessions and bear markets, you go go this link to view an interactive version of the chart above:

https://www.dimensional.com/ca-en/insights/market-returns-through-a-century-of-recessions

Sources:

- Three Crucial Lessons for Weathering the Stock Market’s Storm and a companion visual Market Returns through a Century of Recessions

What I’m Reading

- In the short term, the market is completely unpredictable and volatile. However, you can get a sense of reasonable expected mid-term (7-10 years) returns based on current market conditions and valuations. This article sheds some light on why that is: https://www.morningstar.com/articles/1102371/experts-predict-stock-and-bond-market-returns-bear-market-edition

Disclaimer:

Marc Berger is an IIROC registered investment advisor with Aligned Capital Partners Inc. (ACPI), and as such, you may be dealing with more than one entity depending on the products or services offered. The name of the entity being represented should correspond to the business being conducted. ACPI is regulated by the Investment Industry Regulatory Organization of Canada (IIROC) and a Member of the Canadian Investor Protection Fund (CIPF). Securities are provided by ACPI.

This publication is for informational purposes only and shall not be construed to constitute any form of investment advice. The views expressed are those of the author and may not necessarily be those of ACPI. Opinions expressed are as of the date of this publication and are subject to change without notice and information has been compiled from sources believed to be reliable. This publication has been prepared for general circulation and without regard to the individual financial circumstances and objectives of persons who receive it. You should not act or rely on the information without seeking the advice of the appropriate professional.

Investment products are provided by ACPI and include, but are not limited to, mutual funds, stocks, and bonds. Non-securities related business includes, without limitation, fee-based financial planning services; estate and tax planning; tax return preparation services; advising in or selling any type of insurance product; any type of mortgage service. Accordingly, ACPI is not providing and does not supervise any of the above noted activities and you should not rely on ACPI for any review of any non-securities services provided by (Advisor Name).

Any investment products and services referred to herein are only available to investors in certain jurisdictions where they may be legally offered and to certain investors who are qualified according to the laws of the applicable jurisdiction. The information contained does not constitute an offer or solicitation to buy or sell any product or service.

Past performance is not indicative of future performance, future returns are not guaranteed, and a loss of principal may occur. Content may not be reproduced or copied by any means without the prior consent of the author and ACPI.

Disclosure of commissions in mutual funds in accordance with NI 81-102 (15): “Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. Mutual funds are not guaranteed, their values change frequently, and past performance may not be repeated.