This article is inspired by a call I had at the beginning of 2023 with a young client. After contributing $7,500/month since the beginning of 2022 (a negative year for most public markets), he asked why he had only made minimal returns.

I understand his confusion – “why am I working so hard and contributing so much, only to ‘make‘ $X?”

I reminded him that, as a young investor just starting to build wealth, he may actually be quite lucky to start investing at the beginning of a period of poor market performance, however long that lasts.

Investing while markets are depressed, means you’re buying assets cheaper. Eventually when market performance turns positive, you’ll have compiled more assets at depressed prices.

“Every past market decline looks like an opportunity, every future decline looks like a risk” – Morgan Housel

Investing At The Beginning of a Poor Market Cycle

It’s easy to invest as markets are moving higher and you have a positive feedback loop. But investing at the beginning of a downturn, is not comfortable, and can be outright painful.

An advisor with experience and deep knowledge of the market can help see you through the difficult periods to the benefits on the other side.

In order to help my client understand this, I created the 3 charts below.

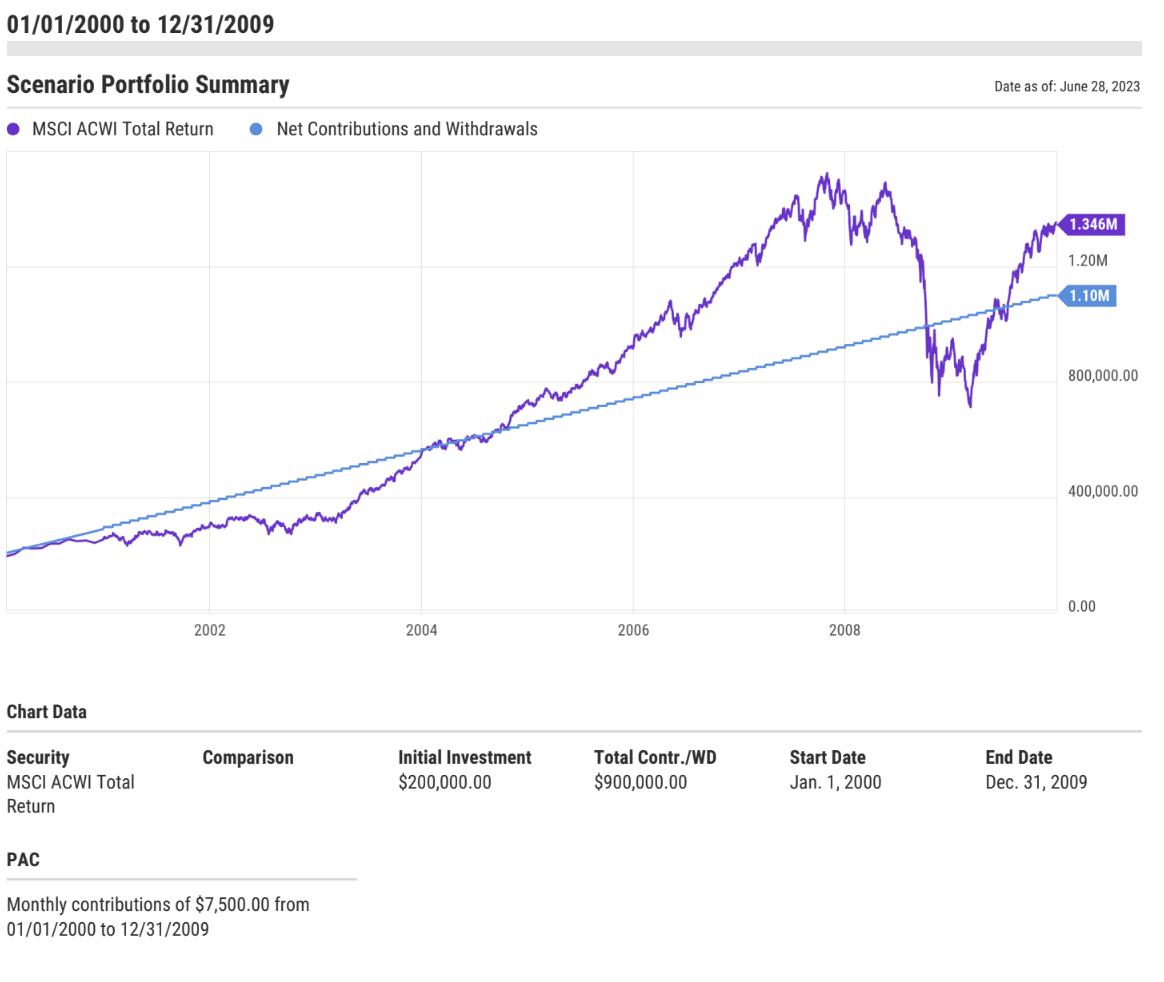

The first chart follows the hypothetical contributions and returns of an individual who started investing monthly in the year 2000, with an initial investment of $200K and $7,500 monthly contributions.

I choose this timeframe because it illustrates my point well – investing at the beginning of a poor market cycle can really pay off.

In fact, that understates the case. The awfulness of the first decade of the 2000’s, is known as the “lost decade” in the US. It was likely the worst decade for the markets ever.

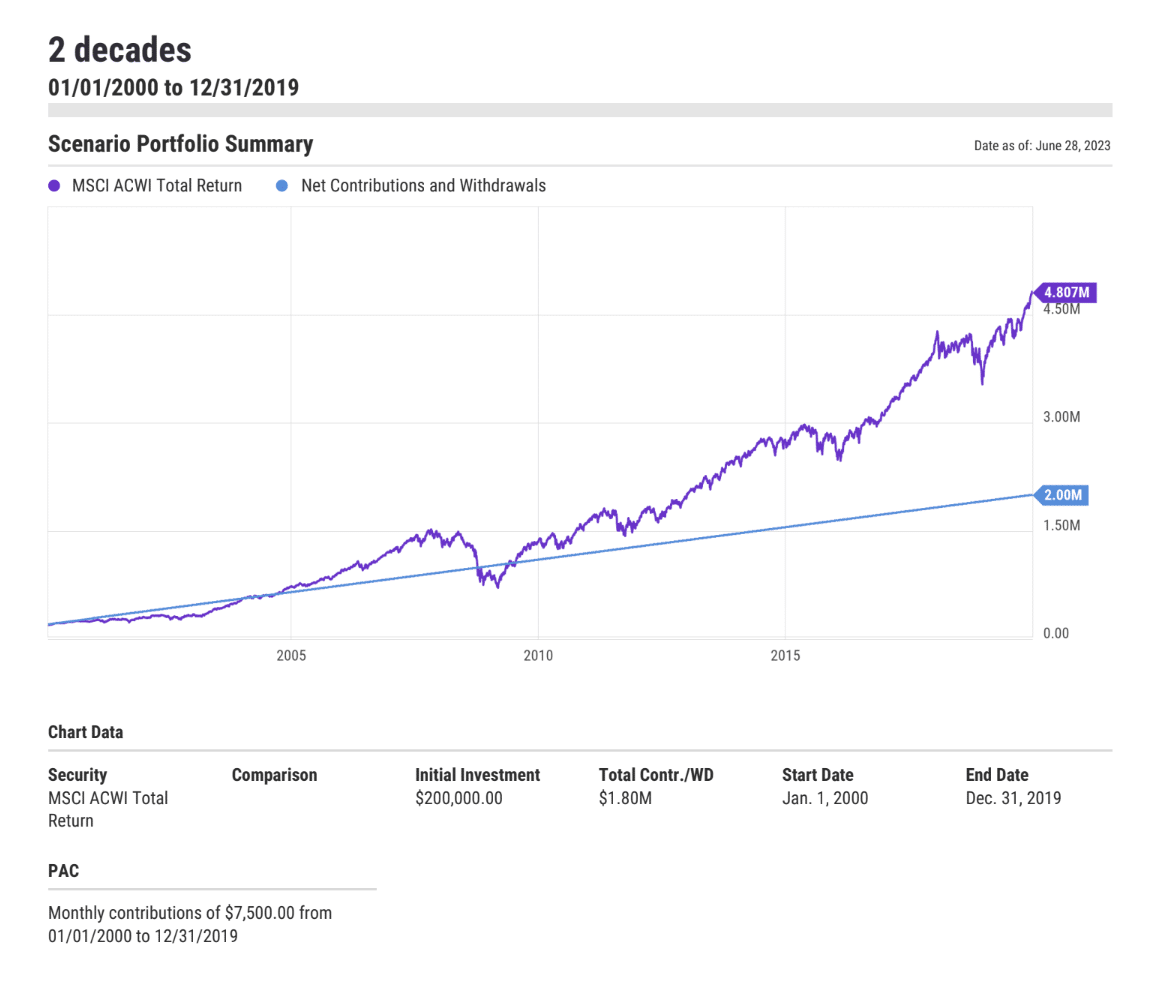

But you’ll see how someone that started, investing then and stuck with it through 2010 right to 2020 (a truly long term time horizon of 20 years), made over $3M in returns, even though there was a “lost decade” for half of that period.

The blue line represents contributions and the purple line represents market value. The hypothetical portfolio shown below represents the MSCI All Country World Index to give you an idea of how the aggregate of global stocks would have done over this period.

From 2000 – 2004 this person made almost nothing. When this happens, it can feel like there’s no reason to invest and your money is better off in a savings account.

From 2004 – 2008, this person made over $1M. This is when you start to feel like a savvy investor who’s made some good choices.

From 2008 – 2009, this person lost all their gains from the last 4 years. At this point, I understand why someone would want to give up. These kinds of losses are crushing and can make you feel like you’ve just wasted years of hard work and discipline.

*Side note: 100% stock portfolio is not appropriate for many investors, especially those with shorter time horizons to when you will need to live off of the portfolio. This is hypothetical to illustrate the point in the article.

Finally, at the end of the decade, there’s a modest total return of about $260K dollars, which can hardly feel worth it after the rollercoaster of emotions from the “lost decade”.

For reference, the S&P 500 was down 9% cumulatively over that decade, assuming you invested a lump sum at the beginning of the decade.

In investing, even a 10 year period can be a relatively short term sample size.

However, when we look forward another decade (2010-2019), this same person’s total market value took off.

They made almost 3 million dollars in that decade alone.

An annualized rate of return of 7.83% for the hypothetical scenario over 20 years (for the 2000 – 2019 period with DCA).

Having extreme patience is a super power for good investors. In theory, it seems like it wouldn’t be that difficult but when it’s your money, it can be very difficult in practice.

Investing At The Beginning of a Good Market Cycle

You can’t time the market. It’s very easy to say in hindsight, “I should have invested in X” or “I should have started investing Y years ago”.

Young investors (business grads, business owners, doctors, lawyers, dentists, etc) will finish their education, start working, and are ready to invest at what may be the beginning of a good market cycle. Does that mean they should hold off until a market downturn?

Definitely not. You have no control over WHEN you start earning money so the best approach is to just start.

While you might not earn quite as much as if you had timed their entrance into investing at the bottom of a market cycle, you will still reap the benefits of 20 years of discipline.

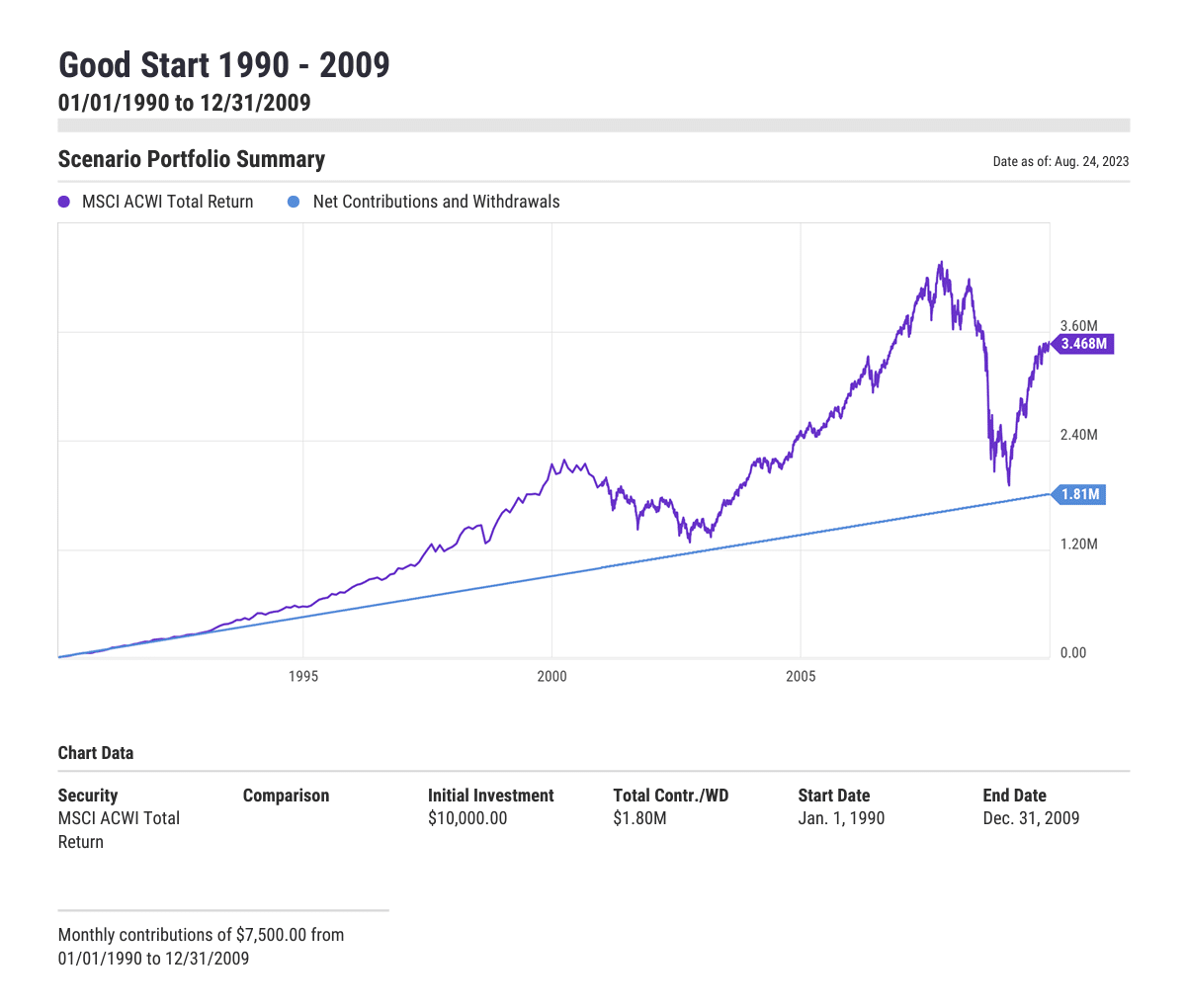

The chart below, shows an example of a person with the same portfolio and contributions but they were made over the course of a different 20 year period (1990-2009).

At the end of this 20 year timeframe, $1.65M in returns were generated.

While this period (1990-2009) didn’t bring in returns as high as the 2000-2019 timeframe, this is still a substantial return over 20 years.

The reality is that if you’re a young investor, it’s better to just start. It’s impossible to time the markets and it’s likely that 20 years of discipline will still be worth it, no matter when you begin investing.

It’s also worth noting that this is a very specific example, where the global financial crisis AND the dotcom bubble happened between 2000-2009. This was an exceptionally poor market cycle and, while it worked out well at the end of this 20 year period, it was very stressful for most investors at the time.

The biggest benefit of starting in a good market cycle is that it would be much easier to stick with your investment strategy because you are receiving positive feedback sooner.

The Daily (Monthly, Even Yearly) Numbers Are Somewhat Meaningless

If we took the stock market at face value, it’s telling us that a business can be worth 5% more one day and then 5% less the next day. No actual business would fluctuate in value that much. Warren Buffett paraphrased Ben Graham in 1987, saying “In the short run, the market is a voting machine but in the long run, it is a weighing machine.”

You have to focus on the long-term to see the value in investing.

Just remember that long-term is not 2 years, 5 years, and sometimes not even 10 years. Long-term is often 20+ years. That’s when you’ll really reap the benefits of your discipline.

Zooming Out To See The Big Picture

One of the greatest values of a good advisor is helping you to stay disciplined, even when you’re uncertain or questioning the value of your investment plan.

They will help you to see the big picture and keep you focused on your long-term goals, while still enjoying your life in the short-term.

And I realize that we will probably have this same conversation for the first 5 or 10 years of working together. That’s ok. That’s part of what I do.