There seems to be a persistent misconception that dividends are some sort of safe magical income from a corporation’s profits.

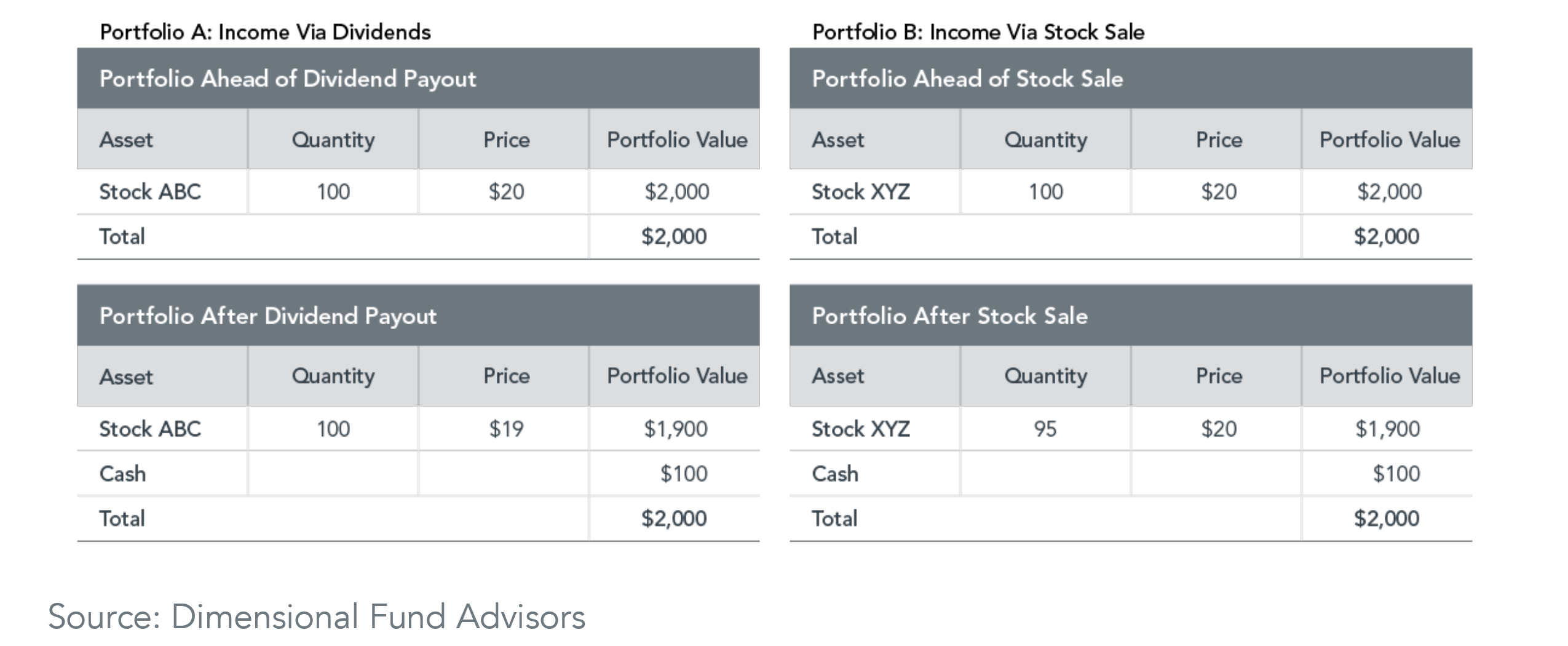

In reality, a dividend is a regular taxable repayment of capital. A 4% dividend essentially reduces a $100 share to $96 and provides you with $4 in a taxable dividend income.

High dividends may reflect a mature company whose best use of cash is paying it out to shareholders. High dividends can also reflect a stock that has lost or is losing value, and the higher dividend reflects that price drop and perceived higher risk from the market. Dividends can sometimes even be funded by a corporation taking on more debt.

Read more about dividends in this article. Below outlines a snapshot of research explored in the article:

“The cash to fund a dividend must come from somewhere, however. We know the price of a stock is potentially influenced by all expected future cash flows to shareholders. If cash is paid today in the form of a dividend, the stock price—and total market capitalization—of the issuing company may therefore fall…”

“Income generation may be a priority for some investors, but other important investment considerations, such as diversification and flexibility, needn’t fall victim to that aim.”