How Recency Bias Affects Investment Decisions

When we don’t have enough information, or conversely feel overwhelmed with the information that’s available, we use mental shortcuts to make decisions. The term for this is cognitive bias.

This happens all the time in investing, no matter how much we’d like to believe that our investment decisions are perfectly logical and rational.

Recency bias is just one type of cognitive bias that can affect investment decisions. This is when greater importance is given to the most recent event or newest information and is common and costly for investors.

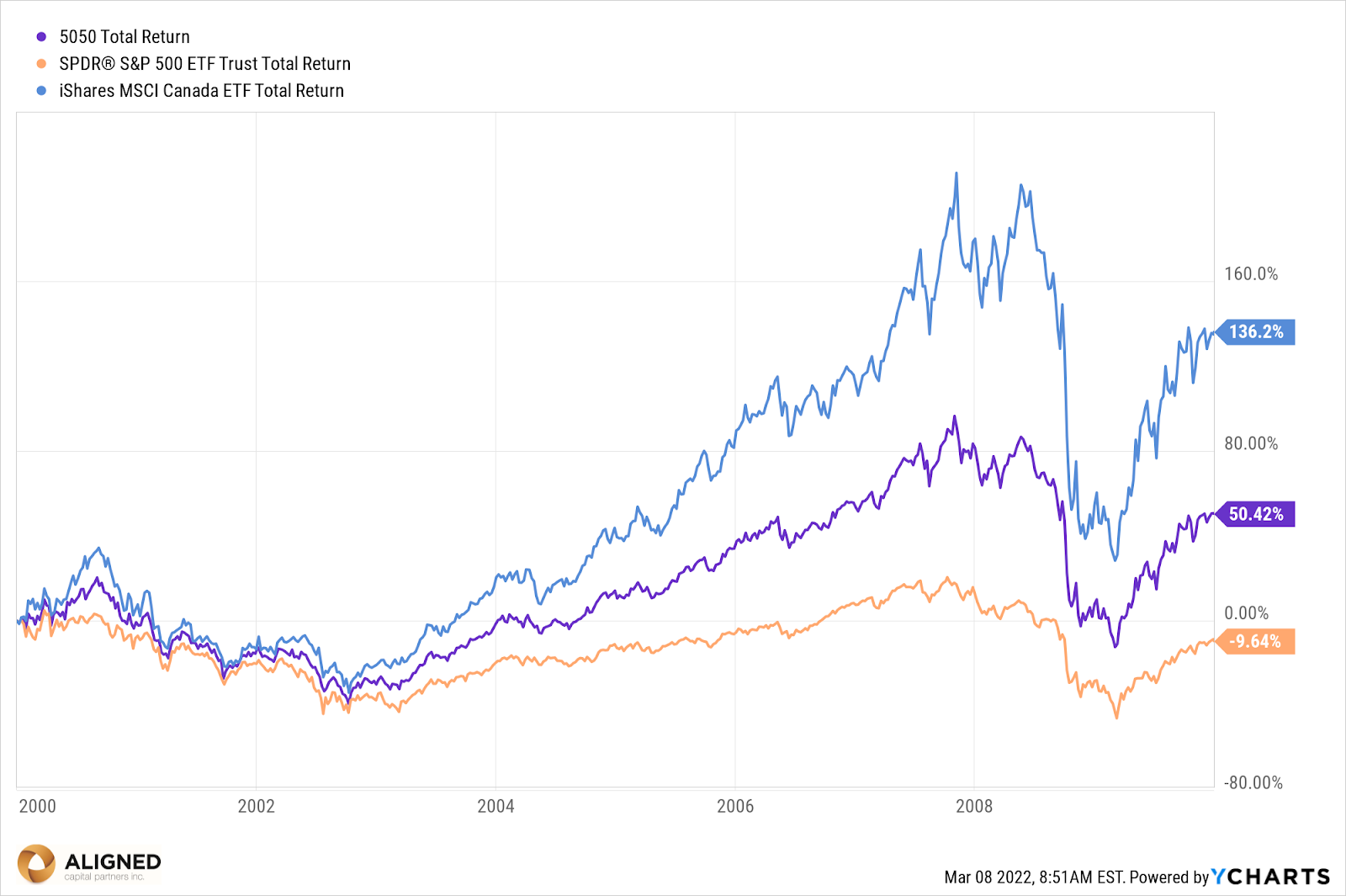

Take for instance, the investment returns of North American equity indices over the past two decades.

In the first chart, we see that from 2000-2009, the US S&P 500 index (represented by the SPY ETF) had a cumulative -9%+ return, while MSCI Canada (represented by EWC ETF) had an overall +136.2% return.

By the end of that decade, Canada was where all investors wanted to be.

This caused many investors to miss out on much of the next decade’s returns from US stocks.

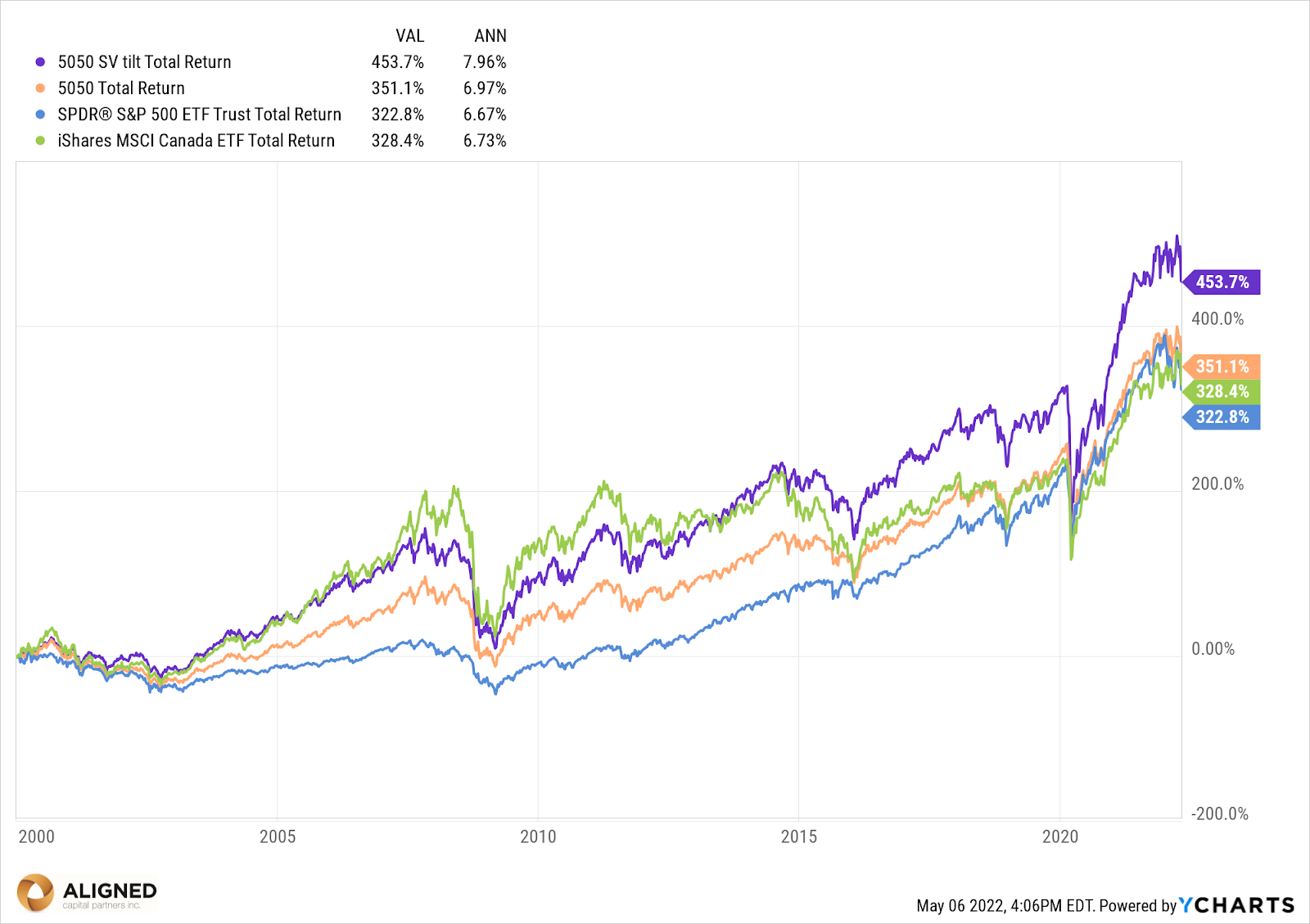

By 2021, investors became eager to allocate money to large US tech stocks and it was hard convincing some to allocate to value and energy stocks.

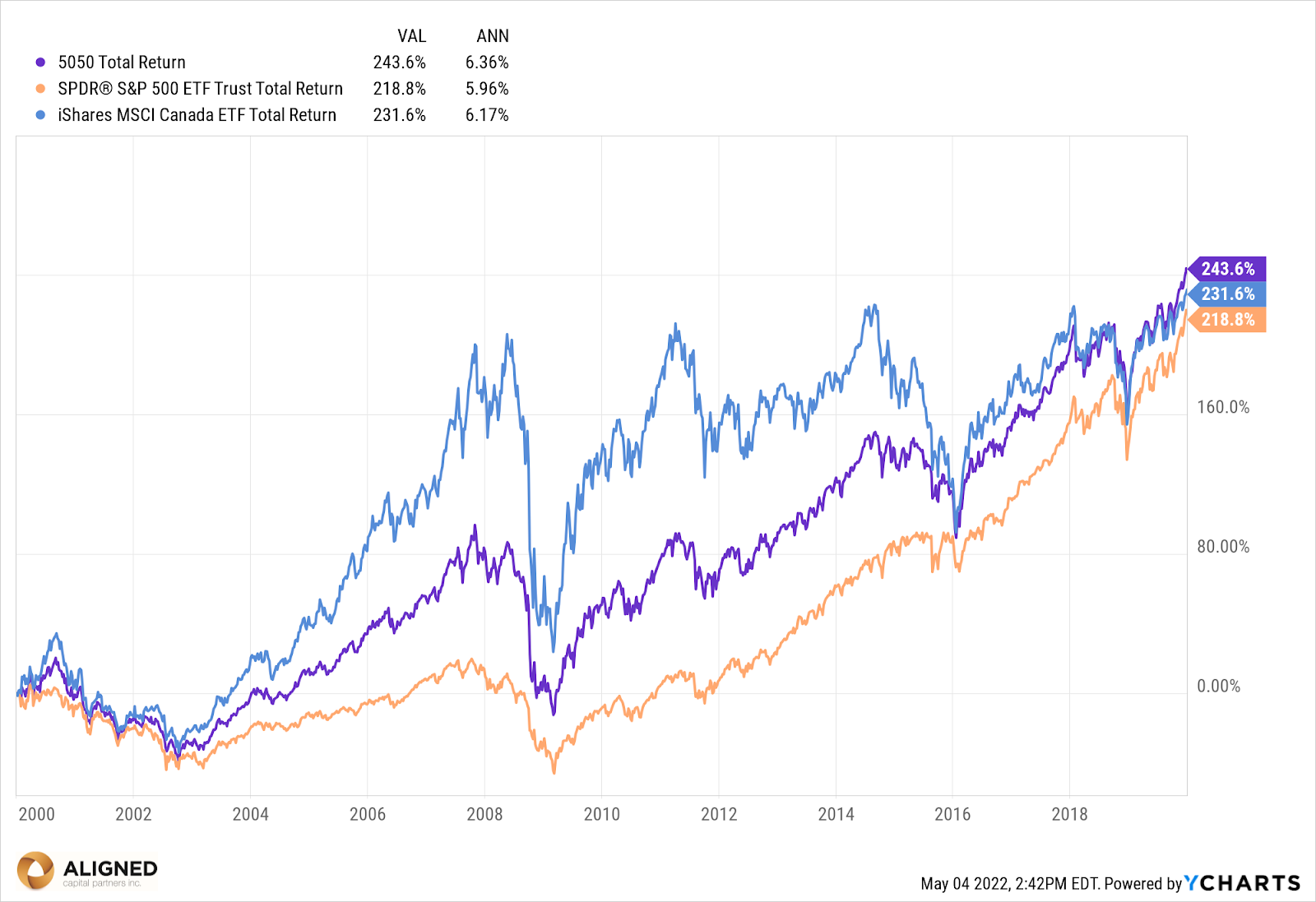

So far in the 2020’s there is no clear winner yet as of April 2022.

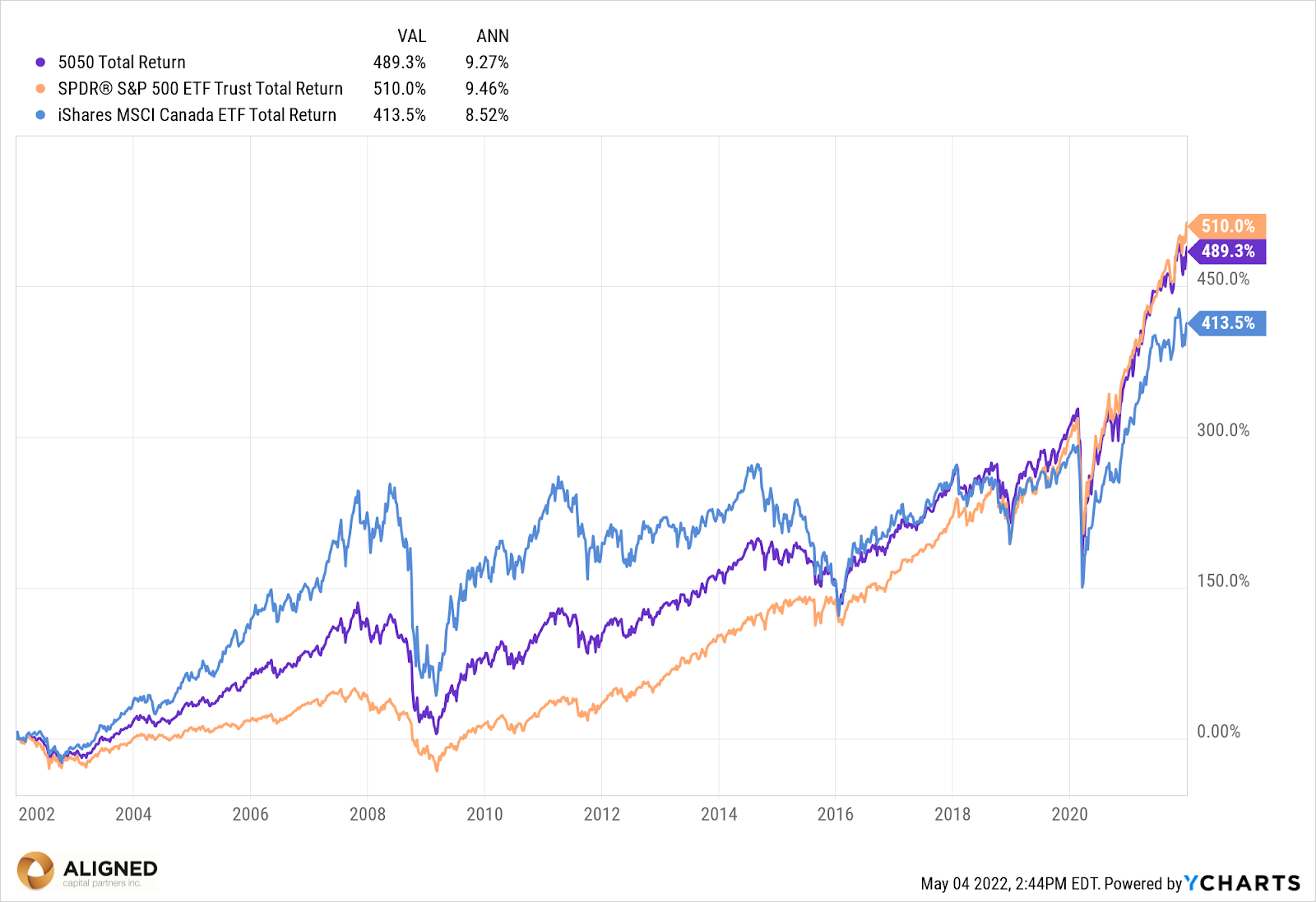

Zooming Out to See A Fuller Picture: The first twenty years of the century (2000-2020) & the most recent twenty years (2002-2022)

If we shift the starting period just two years later, to 2002, after the “tech wreck”, the annualized rate of return jumps up to approximately 9%, up from approximately 6.5%.

This just goes to show how easy it can be to get different information from very similar data.

How Diversification Can Minimize Loss From Recency Bias

As we zoom out to view the last century, 2000 until present date, you can see both markets ending up in a similar spot (below). The purple line in all the charts is a simple 50% combination of both markets represented by two investable ETFs SPY and EWC.

This isn’t meant to be a recommendation to invest in this 50/50 split. The point is to illustrate how diversifying over the long run can give a slight edge over BOTH markets and provides a smoother ride and better investment experience, which will make it easier for investors to stay the course and capture long-term returns.

Disciplined diversification also guards against the dangers of recency bias, the impulse to overweight asset classes that have worked well recently.

Nobody knows what markets will do one day, week, or month from now.

By diversifying you increase the chance of being broadly correct rather than precisely wrong.

In a future post, I will elaborate on how further diversification such as adding equities with certain characteristics (such as overweighting small cap value stocks, seen in purple in the chart below) builds on what has already been discussed above.

Closing Thought

Don’t look at a stock or ETF as a ticker symbol with a price that moves up and down on a screen. It’s a share of a companie(s) profits far into the future. That’s how you ought to evaluate it.

“When we buy a stock, we would be happy with that stock if they told us the market was going to close for a couple years. We look to the business.”

– Charlie Munger

Disclaimer:

Marc Berger is an IIROC registered investment advisor with Aligned Capital Partners Inc. (ACPI), and as such, you may be dealing with more than one entity depending on the products or services offered. The name of the entity being represented should correspond to the business being conducted. ACPI is regulated by the Investment Industry Regulatory Organization of Canada (IIROC) and a Member of the Canadian Investor Protection Fund (CIPF). Securities are provided by ACPI.

This publication is for informational purposes only and shall not be construed to constitute any form of investment advice. The views expressed are those of the author and may not necessarily be those of ACPI. Opinions expressed are as of the date of this publication and are subject to change without notice and information has been compiled from sources believed to be reliable. This publication has been prepared for general circulation and without regard to the individual financial circumstances and objectives of persons who receive it. You should not act or rely on the information without seeking the advice of the appropriate professional.

Investment products are provided by ACPI and include, but are not limited to, mutual funds, stocks, and bonds. Non-securities related business includes, without limitation, fee-based financial planning services; estate and tax planning; tax return preparation services; advising in or selling any type of insurance product; any type of mortgage service. Accordingly, ACPI is not providing and does not supervise any of the above noted activities and you should not rely on ACPI for any review of any non-securities services provided by (Advisor Name).

Any investment products and services referred to herein are only available to investors in certain jurisdictions where they may be legally offered and to certain investors who are qualified according to the laws of the applicable jurisdiction. The information contained does not constitute an offer or solicitation to buy or sell any product or service.

Past performance is not indicative of future performance, future returns are not guaranteed, and a loss of principal may occur. Content may not be reproduced or copied by any means without the prior consent of the author and ACPI.

Disclosure of commissions in mutual funds in accordance with NI 81-102 (15): “Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. Mutual funds are not guaranteed, their values change frequently, and past performance may not be repeated.