As we enter the second half of 2025, it’s a great time to pause, reflect, and prepare. Whether it’s taxes, contributions, or planning ahead for fall, here are the key priorities we’re walking through with clients right now.

Not everything in this email is for everyone. I’ve broken it down into three sections so you can easily find the information that’s most relevant to you:

- Mid-Year Check-In for Your TFSA, RRSP, RESP & Other planning

- Back-to-School Planning: Time for RESP Withdrawals

- Q2 Market Snapshot

1. Mid-Year Check-In for Your TFSA, RRSP, RESP + Other Planning

Now that we’re halfway through the year, it’s a smart time to revisit your registered account contributions and if applicable, your non registered and corporate savings action plan.

Are you on track, behind or ahead? Most people have their NOA’s by now and MyCRA portal is usually up to date this time of year, making it a great time to update planning.

![]() TFSA

TFSA

- The 2025 TFSA limit is $7,000.

- If you’ve been eligible since 2009, the total lifetime room is now $102,000. In individual circumstances this number may be higher.

- Remember: TFSA withdrawals made in 2024 were added back to your room in 2025.

TFSA growth and withdrawals are tax-free, which makes it a powerful tool for both long-term investing and short-term goals.

![]() RRSP

RRSP

- For many, RRSPs remain the best way to reduce taxable income.

- If you had a big income year in 2024 (bonuses, gains, business income), you might want to catch up now and front-load your RRSP contributions before next February’s rush.

![]() RESP

RESP

- If you’re contributing for a child or grandchild, don’t miss out on Canada Education Savings Grants (CESG) — 20% on the first $2,500 per child, per year.

- Haven’t contributed in a while? You can catch up on unused CESG room, too.

![]() Corporation & or personal non-registered investments

Corporation & or personal non-registered investments

- Let’s review your action plan. Are you on track, behind or ahead? Are you on top of installment taxes? Is your compensation plan optimal?

Let’s plan ahead and do a quick review. It’s better to be proactive, not reactive.

2. Back-to-School Planning: Time for RESP Withdrawals

If your child or grandchild is heading off to college or university this fall, it’s time to start planning RESP withdrawals.

There are two types of RESP withdrawals:

- Educational Assistance Payments (EAPs): Includes grants and growth. Taxable to the student (often minimal).

- Post-Secondary Education (PSE) Withdrawals: Just your original contributions. Non-taxable.

Getting the timing and structure right helps minimize taxes and maximize grant usage. If you have questions, now is a great time to walk through the options before September.

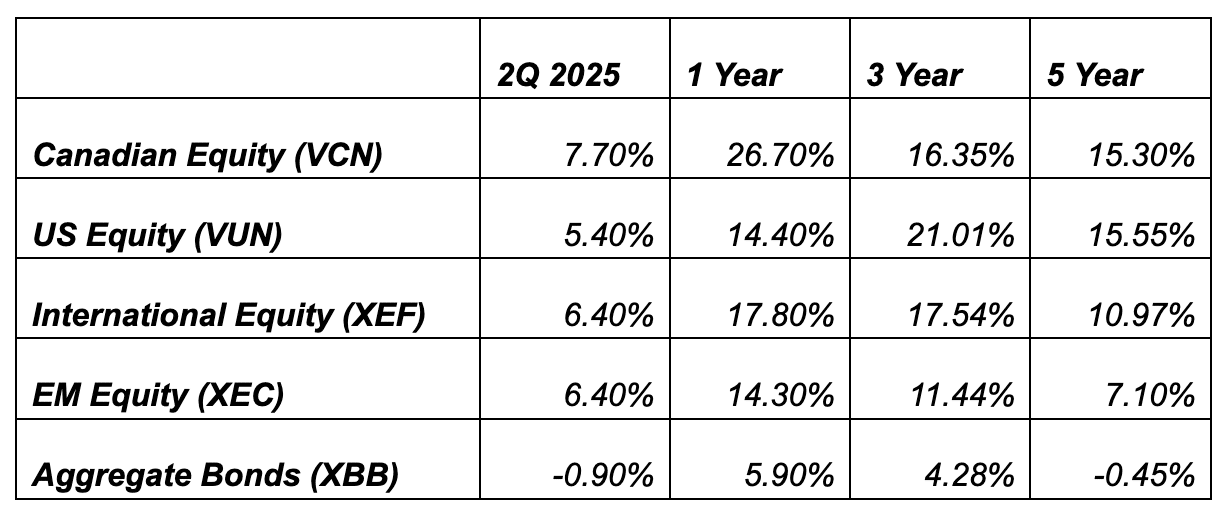

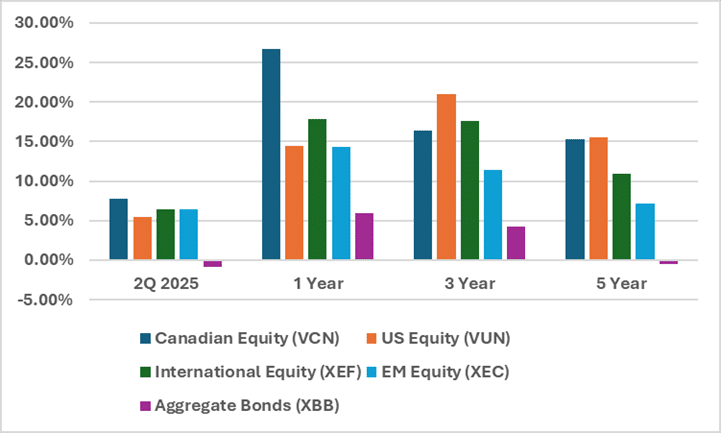

3. Q2 Market Snapshot: Strong Equity Gains and a Shift in Sentiment

“Don’t just do something, stand there” – Late Vanguard founder, Jack Bogle

Tariff announcements, middle east war, and strong overall returns – you can’t forecast this stuff.

If ever you need a reminder of why we don’t time the markets, Q2 is a great example. Peak to trough sell-off for the US Stock market was about -18% and then rebounding back to finish up 5.4%. That’s a solid result, and it is amazing the roller coaster it took to get there.

Note: The returns reported here are total returns, which include both price appreciation and reinvested dividends/distributions.

Let’s Make the Second Half of 2025 Count

The midpoint of the year is a great time to tighten up loose ends — from contributions to taxes to education planning. It’s also a smart time to look ahead and position yourself for the rest of the year.

If any of the above applies to you, or you simply want to talk strategy, let’s schedule a time to connect.

We’re here to help.