I just wanted to share a quick post about four notable ideas I’ve come across in the last couple weeks.

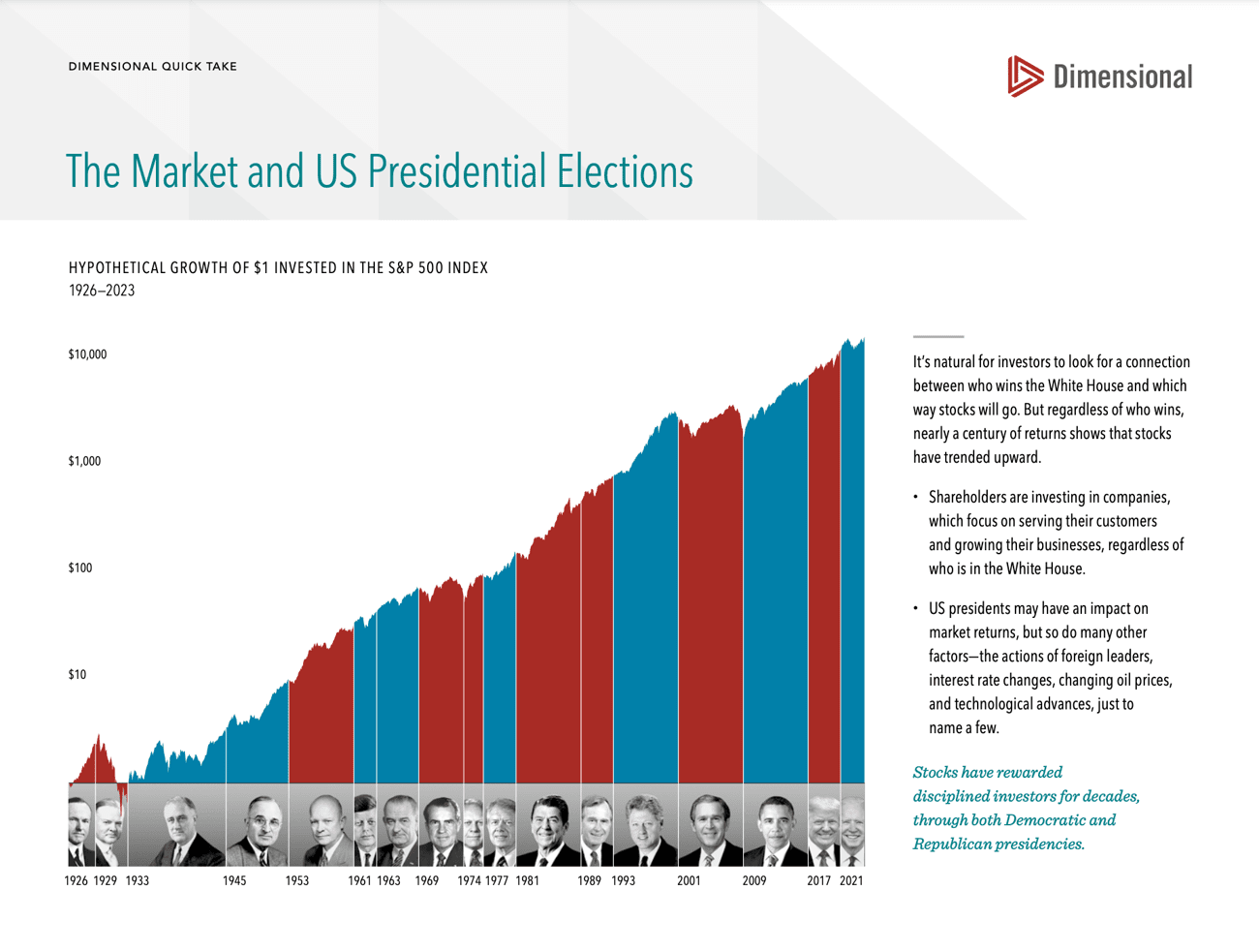

Equity Markets and The US Election

With all the focus ramping up on the upcoming US presidential election, I thought it would be a timely topic to discuss equity markets and political parties.

History shows that, although the outcome of an election may affect markets, so do many other variables such as interest rates, geopolitical issues, oil prices etc. Historically markets trend higher no matter who the president is.

Source: https://www.dimensional.com/ca-en/insights/elections-and-the-march-of-markets

Source: https://www.dimensional.com/ca-en/insights/elections-and-the-march-of-markets

Investor Psychology

Podcast: Memos from Howard Marks

Episode: The Folly of Certainty

A short (19 minute) podcast about the pitfalls of absolute certainty – in politics, investing, or any other complex system (life?). This is why you should be weary of investors that use terms like, “will”, “won’t”, “has to”, “can’t”, “always”, or “never”.

A short (19 minute) podcast about the pitfalls of absolute certainty – in politics, investing, or any other complex system (life?). This is why you should be weary of investors that use terms like, “will”, “won’t”, “has to”, “can’t”, “always”, or “never”.

Howard is the Co-Chairman of Oaktree Capital Management, the largest investor in distressed securities worldwide.

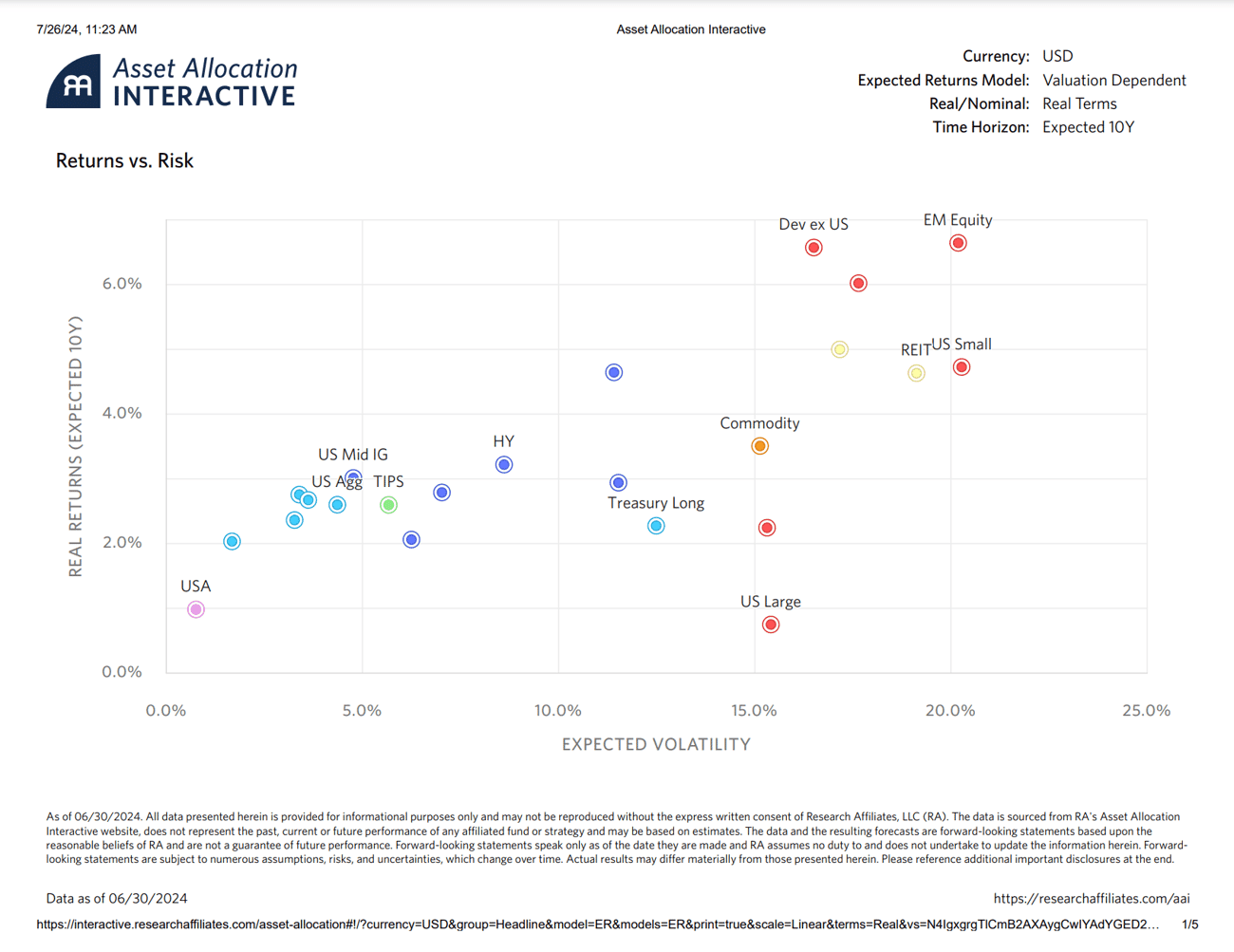

Research

Expected 10 Year Real Returns

Shows expected 10 year real (not nominal) returns vs. risk for assets classes. Despite the fact that expected future US returns look low and international returns look good, there is no certainty in markets, as per the theme of this email. This is to provide a probabilistic outlook and it would be prudent for investors with heavy US centric portfolio’s to diversify internationally.

Business Building

Blog Post: Fill The Bathtub

A short, but interesting essay about truth and trustworthiness. Ted Lamade, Managing Director at The Carnegie Institution for Science, explores why trust is so rare these days – online, in the media, in business – and what this means for our society.

What I found especially interesting is how Charlie Munger and Warren Buffet have built their entire empire on trust. They employ a “trust first, ability second” approach to all aspects of their business and that seems to have worked out quite well for them.