“Liquidity makes [Investors] do stupid things. The fact that you can get out of [an investment] ten minutes later – which you can’t do with a farm or an apartment house – should be your friend. But they turn it into a negative.” – Warren Buffett

With everything going on in the world, I wanted to share some charts to remind us all to zoom out and tune out the noise.

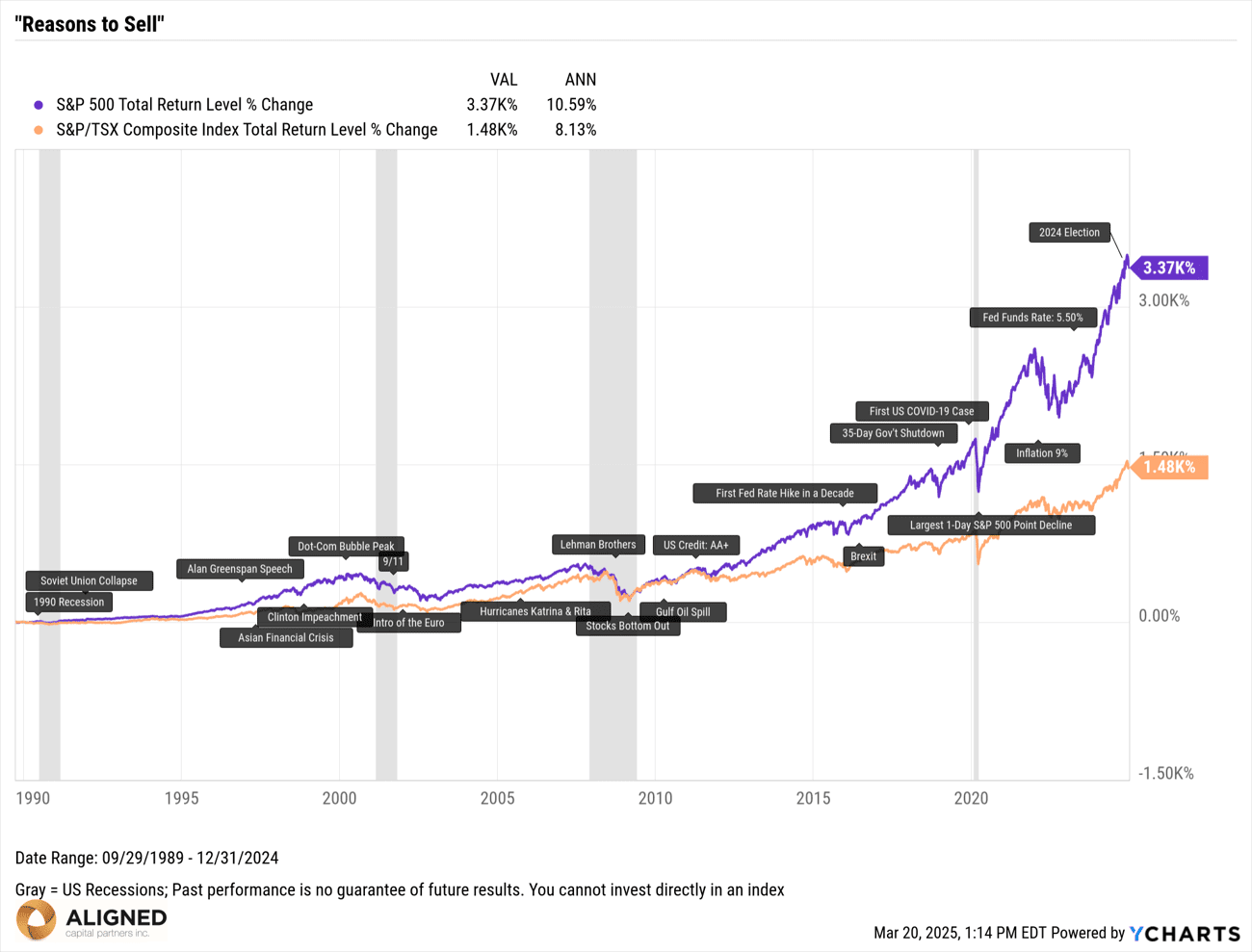

Chart 1

The market has always climbed a wall of worry. There’s always a reason to sell.

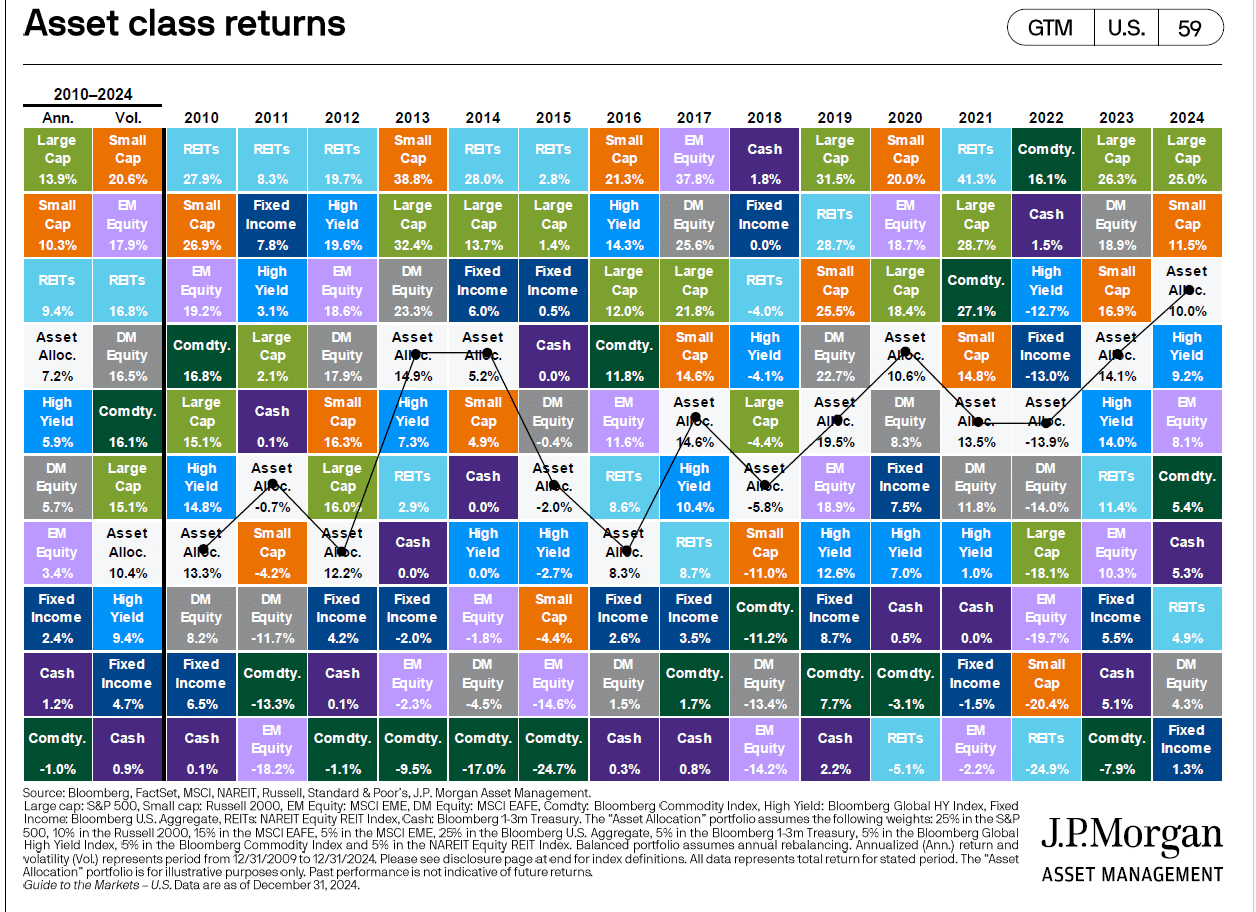

Chart 2

Asset Class Returns

The order of returns for each asset class is not predictable year to year. Look at the order from bottom (worst) to top (best) each year. A diversified portfolio will help smooth the ride.

The US doesn’t always outperform, growth stocks don’t always outperform, stocks don’t always outperform. Be diversified. Don’t fall prey to recency bias.

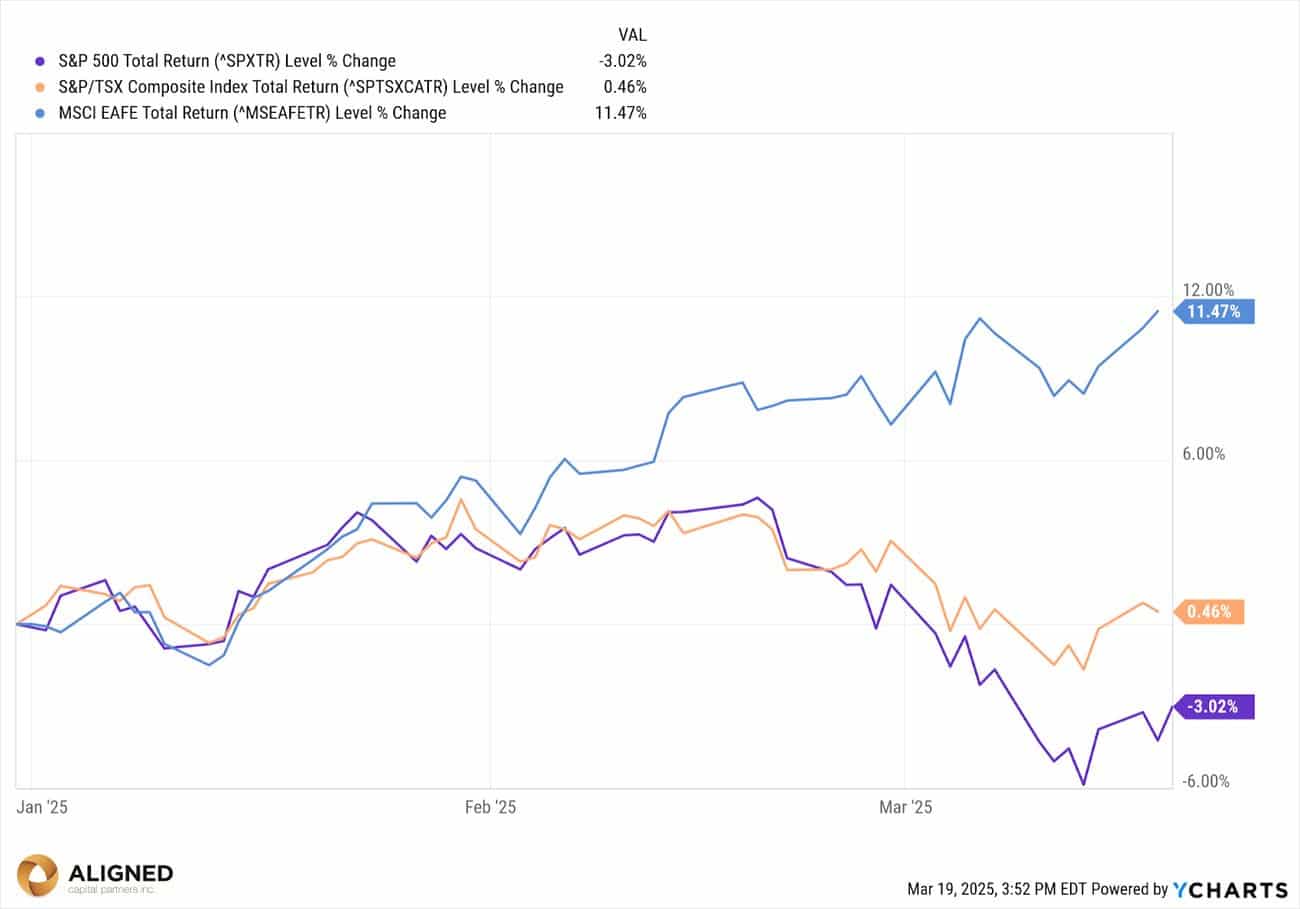

Chart 3

Regional diversification still works. Despite US markets’ outperformance for the most recent decade plus, it doesn’t always workout that way.

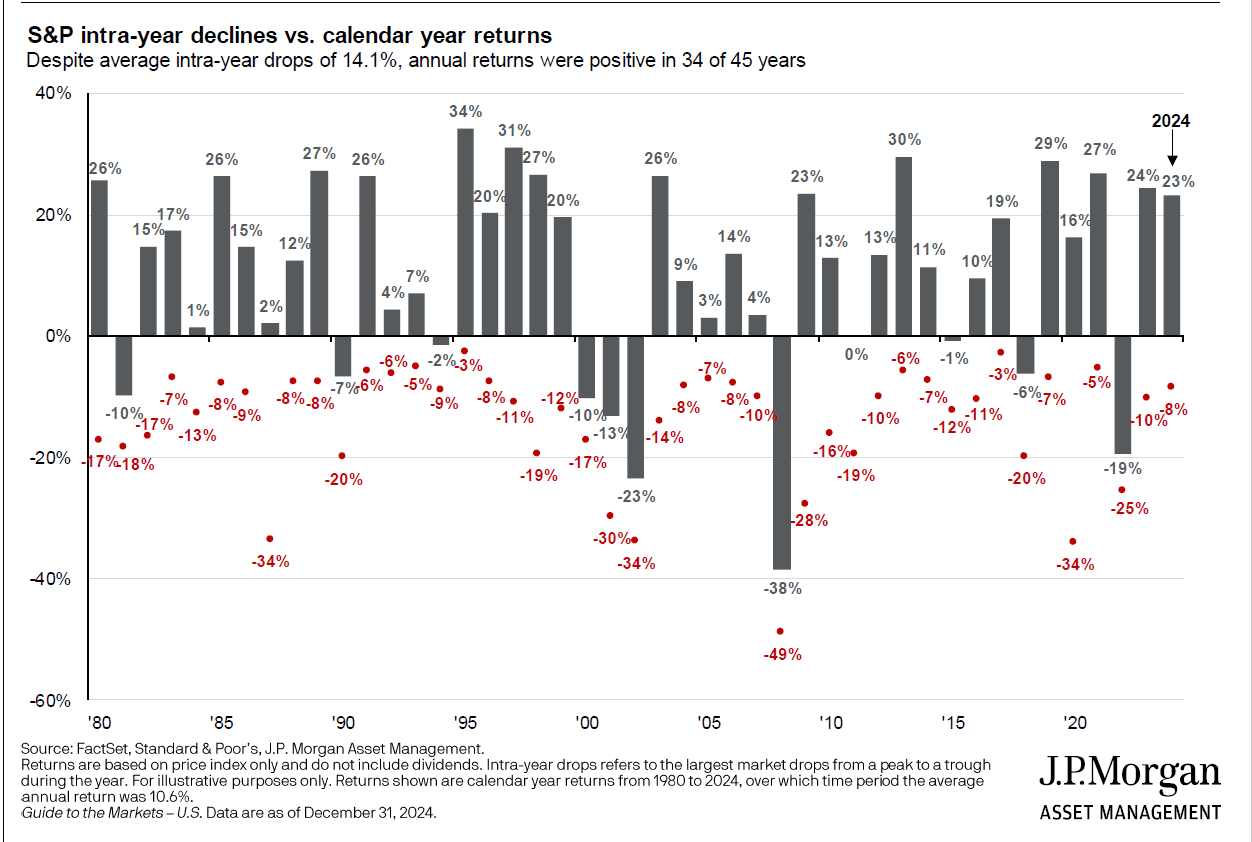

Chart 4

This is an oldie but a goodie. Institutional allocators may thumb their nose at retail investors, but they exhibit bad behavior themselves chasing returns. They hire managers with strong 3, 2 and 1 year performance.

They would have been better not doing anything or even the opposite. Don’t chase returns!

Buffett have out-performed the US equity market, while most other can’t, is because he can go through long periods of underperformance (8 out of 10 years in one period). Most institutions would fire a manager after just 2 years!

The key is to have a plan for a diversified allocation you can stick with. Simple but not easy.

WHAT I’M READING

Beautiful vs. Practical Advice – A short but insightful article about why what we’re looking for or what we want, isn’t often what we need.