As I write this post in June 2023, I don’t have any predictions for the remainder of 2023.

Why? Because my job is not to correctly predict the future and it shouldn’t be.

In fact, nobody is really any good at this, especially economists. As the great baseball legend Yogi Berra put it:

“It’s tough to make predictions, especially about the future”

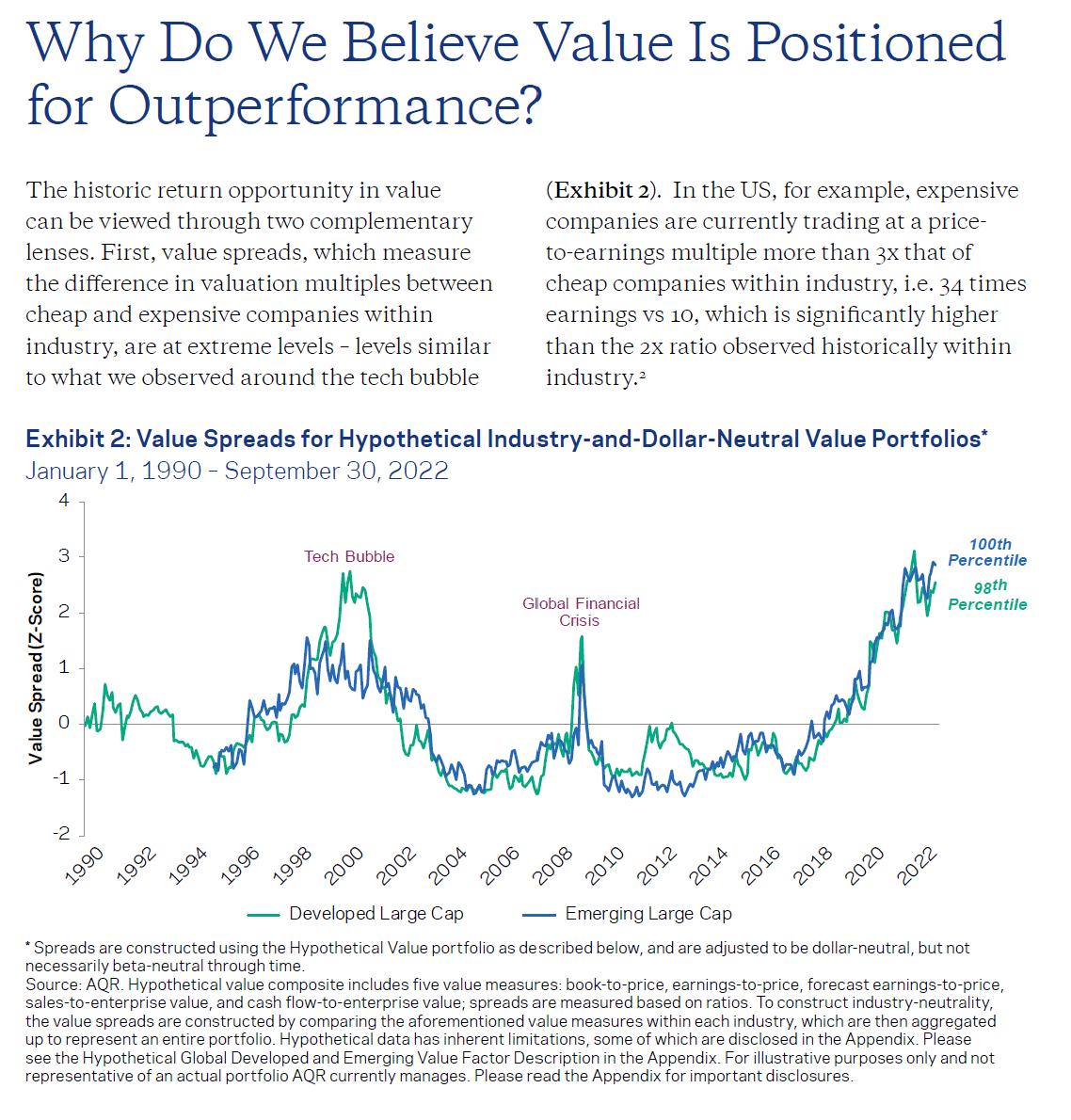

I can share my insights on areas of risk that I see, as well as areas of opportunity. For example, I see a big relative valuation gap between Value and Growth stocks (see Table 1 below, or visit: Value: Why Now? Capturing the Comeback in Its Early Innings).

However, I can’t predict if or when that gap may close and provide ‘Value’ investors an edge. This is an observation, not prediction, and it’s based on current valuations and long-term historical data.

If you look for a market forecast from 10 different banks or asset managers, you’ll get 10 different answers. Markets are complex systems with a near infinite amount of variables that could affect them, including wars, new political policies, a pandemic, changes in investor sentiment (fear and greed), and black swans (never before seen unknowable in advance events), etc.

That’s why a financial plan and investment plan ought not be built on a foundation of predictions.

Predicting does not mean merely recognizing a risk. It means claiming that something *will* happen. To heed a *prediction* seriously is to act as if the predicted event were indeed bound to happen. – George Selgin

The Best Plan Is Built On A Foundation of Risk Management

There is risk inherent to everything. There’s risk to investing and there’s risk in keeping your money in cash.

When you think about planning for the future, both near and distant, it’s better to acknowledge that risk is unavoidable and plan accordingly.

The best way to do this is to have a money management plan and investment strategy with a set of disciplined and systematic rules. This will help protect you, your retirement plans, and give you peace of mind.

This isn’t comprehensive list but here are 4 ways we achieve this with our clients:

- Evaluate your Risk Tolerance.

There are two areas to be considered with regard to risk tolerance. First is your financial capacity for risk, how much downside risk can you withstand financially that your withdrawals for income don’t create a permanent loss of capital (this is sequence of return risk – https://www.investopedia.com/terms/s/sequence-risk.asp).Secondly, there is the emotional and mental component of risk tolerance, which will be different for everyone. Figure out what you can tolerate without abandoning your plan or losing sleep.When reviewing your investment portfolio, try to look back at historical drawdowns (Table 2 Below) for the type of risk level that you’re in and honestly ask yourself if that’s something you can stick with, it is a feature of markets and will happen again in the future. Don’t just look at percentage drawdowns for the past. Figure out what that means in dollar terms, which might feel more real to you.

Remember, a good plan only works when you stick to it, which is much more difficult to do under extreme stress. Paraphrasing David Booth, founder of Dimensional Funds, in response to the tendency for investors to abandon their investments after a down market, “You stuck around for the losses you may as well stick around for the returns”.

Make sure your level of comfort with your portfolio allows you to stick around.

- Create a Cash Wedge or Emergency Fund. A cash wedge is a predetermined amount of your wealth that you’re going to keep in cash. This is done so that you can stick with your investment portfolio in tough times. You do this knowing that you’re likely trading off some returns for peace of mind.If you’re retired, you’ll have peace of mind knowing that the cash you need to spend over the next year or two is safe, and you can give your investments the time they need to recover, uninterrupted.For those in the accumulation stage of life, an emergency fund is key so that when big expenses or big life changes happen, you don’t have to touch your portfolio to cover unexpected expenses. Depending on your job security and circumstances, a reasonable emergency fund can be an amount that would cover anywhere from 3-12 months of lifestyle expenses.

- Diversify your Portfolio – The only free lunch in investing.

“The only free lunch in investing” is a term coined by Nobel prize winner Harry Markowitz. His work showed that diversification across different asset classes could reduce risk without reducing expected returns. Or within individual assets, increase returns without increasing risk.You could try to find the needle in the haystack but you’re better off buying the whole haystack. You could comb through thousands of unknown public companies to find the next Amazon or Apple, but the odds of success, even for professional investors, are massively against you.When you buy the whole market, you’re bound to capture those winners and they’ll drive the lion’s share of your returns.

You can further this diversification to overweight certain factors – value, profitability, and smaller sized businesses to capture higher long term expected returns.

By creating a diversified portfolio, whether it’s across equity markets, or between different asset classes, such as bonds, real estate, cash, commodities, you can reduce your risk of rare but spectacular declines and increase the probability of a positive future outcome.

- Accept/Acknowledge Uncertainty and Prevent Against Complete Ruin.

This last point highlights the role of our psyche and perspective around money and investing. A successful investor might think about finances like driving.A good driver understands that anytime they go out for a drive, they could be in an accident. We lower the odds and potential impact of an accident by driving within reasonable speed limits, obeying the rules of the road, buying a safer car, wearing a seatbelt, buying insurance, trying to avoid driving in storms, etc.Yes, this all costs time and money, but we intuitively know taking these extra protective measures are worth it because they reduce the chances of a catastrophic outcome. It doesn’t matter that 99 out of 100 car drives are successful, if one of them ends in tragedy.

The same applies to investing. We can buy life and disability insurance to protect our ability to earn income and invest, we can diversify our portfolios, and maintain emergency funds or cash wedges, all with the aim of improving the odds of reaching our goals safely.

In driving and investing, there’ll be bumps along the way, ranging from curb rash to fender benders to potentially scary accidents.

There’s always some level of risk that’s out of our control. In both cases we acknowledge and accept this uncertainty, knowing we’ve controlled what we can.

If it’s been awhile since you’ve thought these things through, there’s no time like the present to reach out.

TABLE 1

TABLE 2

What I’m Reading

- Top Three Investment Ideas to Consider for 2023From AQR a short video on areas where prices are in investors favour. Again, not a prediction but an evaluation of risk/reward benefits.

- Show Us Your Portfolio: Ben Hunt on SpotifyA key lesson for investing. “Investing in the Real” means getting as close as you can to real cash flows from real things made for real people in the real economy. – Ben Hunt

- Volatility Laundering on Private EquityGiven the massive popularity of private investing today, it may very well be true that, as a great man once almost said, “Never have so many paid so much to so few for the privilege of being told so little.

- The Oil Kings: How the U.S., Iran, and Saudi Arabia Changed the Balance of Power in the Middle East (Audible Audio Edition)Andrew Scott Cooper draws on newly declassified documents and interviews with some key figures of the time to show how Nixon, Ford, Kissinger, the CIA, and the State and Treasury departments – as well as the Shah and the Saudi royal family manoeuvred to control events in the Middle East. He details the secret U.S.-Saudi plan to circumvent OPEC that destabilised the Shah. He reveals how close the U.S. came to sending troops into the Persian Gulf to break the Arab oil embargo. The Oil Kings provides solid evidence that U.S. officials ignored warning signs of a potential hostage crisis in Iran. It discloses that U.S. officials offered to sell nuclear power and nuclear fuel to the Shah. And it shows how the Ford Administration barely averted a European debt crisis that could have triggered a financial catastrophe in the U.S. Brilliantly reported and filled with astonishing details about some of the key figures of the time, The Oil Kings is the history of an era that we thought we knew, an era whose momentous reverberations still influence events at home and abroad today.