With the recent turbulence in the market, the predictability of bonds can seem appealing.

While understandable given the current state of things, most investors appreciate that the expected returns for stocks is significantly higher than the expected returns for bonds over the long run.

The following is a useful framework to understand why this is the case and when you might consider bonds to be a more valuable investment, over a global stock portfolio.

The Equity Bond Concept

One of Warren Buffett’s investment frameworks is the concept of the Equity Bond. It compares stocks earnings yield with the yields on traditional bonds. This framework helped him to build enormous wealth over time.

This concept will allow you to do three things:

- Compare stocks to bonds

- Identify potentially undervalued or expensive investments

- Help you make rational allocation decisions between asset classes

Instead of fixed interest payments, like you would get from bonds, the yield on stocks comes from the company’s earnings (not dividends). I’ve discussed the error associated with conflating dividends with profits here: https://marcberger.ca/

Equity Bond Calculation

Simply, take the net income of the business on a per share basis and divide that by the stock price.

That will provide you with the Earnings Yield. Earnings Yield = Annual Earnings Per Share / Stock Price

This allows us to compare the percentage return we’re “buying” when we buy a stock to that of a bond’s yield.

Let me provide a simplified example (instead of using an individual stock) using a globally diversified equity index fund or ETF.

Example:

Lets use a hypothetical global equity index ETF with a current price of $100/share.

Earnings per share (over the past 12 months): $5

Earnings yield: $5/$100 = 5%

Comparison:

Hypothetical 10-year Treasury Bond Yield: 4%

In this example, the global equity index fund is yielding 1% more than risk-free government bonds.

Here’s where the concept gets interesting…

Of course equities have more volatility and uncertainty than bonds.

But, equities can grow earnings over time. If the equity index fund can grow earnings at 6% annually, the “true yield” will grow. Let’s see how that works.

Growth of Equity Bond Yield Over 15 Years

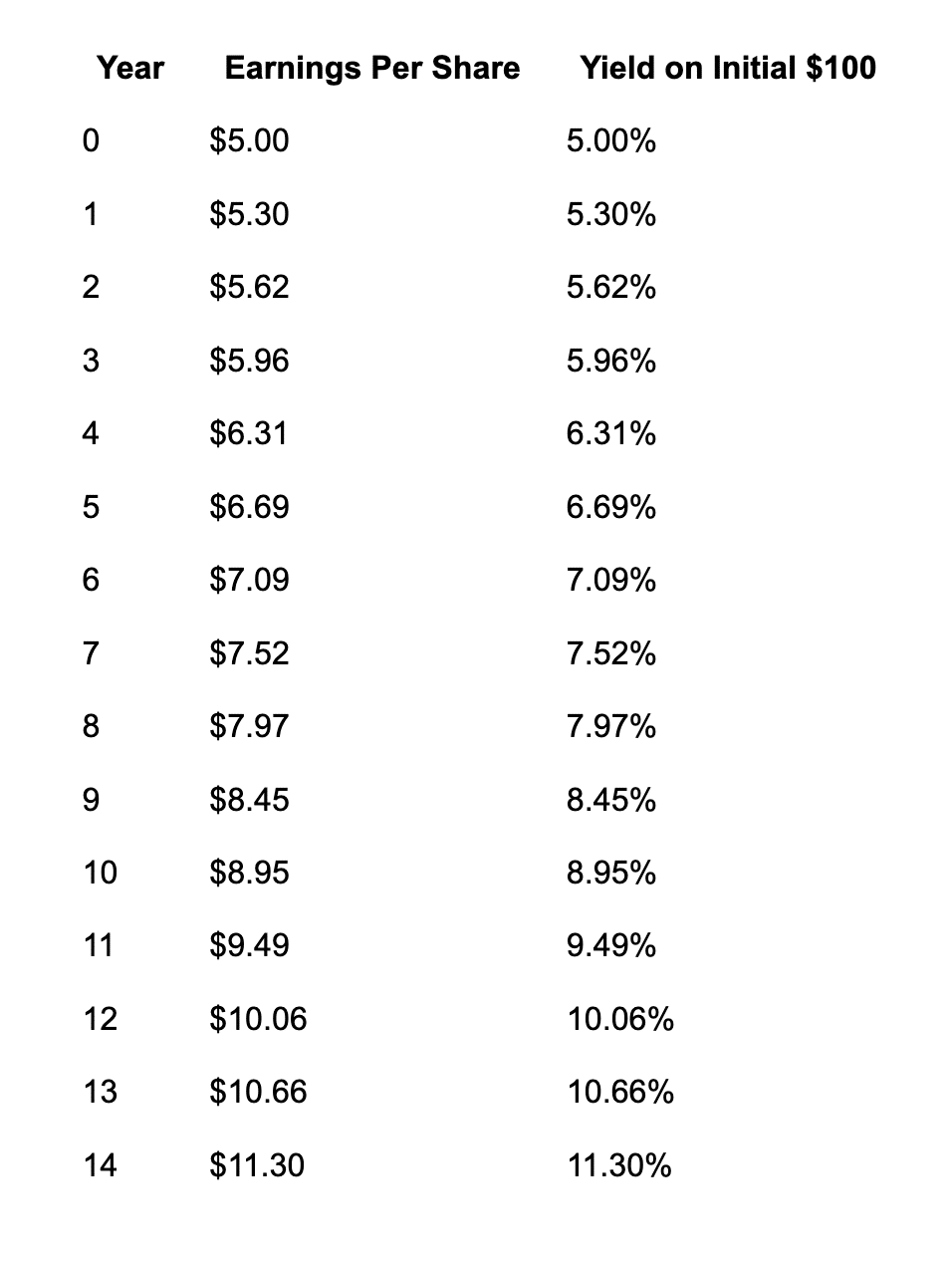

Let’s calculate how the yield on an initial $100 investment in our hypothetical global equity index fund would grow over 15 years, using our initial earnings of $5 and a 5% earnings yield as well as an assumed earnings growth rate of 6% annually.

Year-by-Year Progression

Here’s how the yield on your original $100 investment would grow:

What This Means

After 15 years:

- Your initial investment $100 (ignoring market price changes)

- The earnings power of that initial investment has grown to $11.98 per year

- That represents a 11.98% yield on your original investment

- Your effective yield has more than doubled from the initial 5%

So what? Over time, the stock price and any dividends paid out to the shareholders should grow to reflect earnings.

Key Takeaway

The 5% earnings yield on your initial cost base has grown to nearly 12% over 15 years, while a traditional bond purchased at the same time would still yield only its initial rate.

If you had purchased a 4% bond instead, you would still be earning exactly $4 per year on your $100 investment after 15 years (assuming you reinvest again at the same yield after 10 years). With the equity investment, you’re earning nearly $12 on that same $100, demonstrating why Buffett considers quality stocks to be “bonds with rising coupons.”

This is the fundamental advantage of equity investments held for the long term – the income stream grows with the underlying businesses, providing both increasing returns and inflation protection.

This is fundamentally different frombonds, where the yield remains fixed.

This simple yet powerful framework helps explain why Buffett has historically favored equities, especially during periods of low interest rates, and shifted to t-bills or cash when equity valuations became excessive relative to their earnings yields.

WHAT I’M READING & LISTENING TO

A Quote on Market Timing

“Just wait for the fat pitch” – why this advice isn’t as good as it sounds.

“…. Markets are moving faster than ever. You don’t have as much time to wait around for the fat pitch as you used to. Plus, valuations are higher now than they were in the past.

The long-term average CAPE ratio going back to 1871 is 17.6x. Do you know how often the market has been trading below that uber-long-term average for in the past 30 years?

Just 10 months out of 360 in total, or less than 3% of the time. And all 10 of those months were in 2008 and 2009 during the Great Financial Crisis.

Waiting for the fat pitch sounds like an awesome idea until you realize the market doesn’t wait around for you to be comfortable enough to invest.

You’re better off investing on a regular basis and avoiding the brain damage that comes from trying to time the market.”

Podcast:

Tariffs, Market history and the current market decline – Morgan Housel

https://open.spotify.com/episode/1YaPTsUphBwZLdBhyllPwq?si=0bacd23324954e53

Podcast:

Nobody knows: Howard Marks

https://open.spotify.com/episode/2B9SDmY9B6HGiNmJAGHJu2?si=2a4fa7c845954ac5

White Paper:

Beyond the Status Quo: A Critical Assessment of Lifecycle Investment Advice. – Scott Cederburg

Searching for the optimal fixed-weight allocation strategy that maximizes expected retirement utility. The results may surprise you and go against much conventional wisdom as espoused in employer sponsored retirement plans.