I have a friend who always talks about how he’s waiting for a big market crash.

When it does, he’s sure he’ll make a killing in the market, buying everything at a discount.

This is his ‘get rich’ investment plan.

But what is the likelihood of success of this plan?

Firstly, he runs the risk of missing a prolonged bull market.. The eventual crash he waits for may never fall to a level lower than when he started waiting.

Furthermore, even if he gets lucky and a crash materializes, the bottom can be hard to time and things can turn on a dime. In fact, during the 2020 Covid-19 related crash. He was expecting a market bottom of 50% from the highs but it never got there. Oops!

Most investors eventually miss the opportunity once it does present itself. You have to time the market twice! Before the crash AND when getting back in.

So what’s my solution?

Properly diversify, invest at all-time market highs AND lows.

Investing At All-Time Highs

There is good evidence that investing at all time highs works well most of the time.

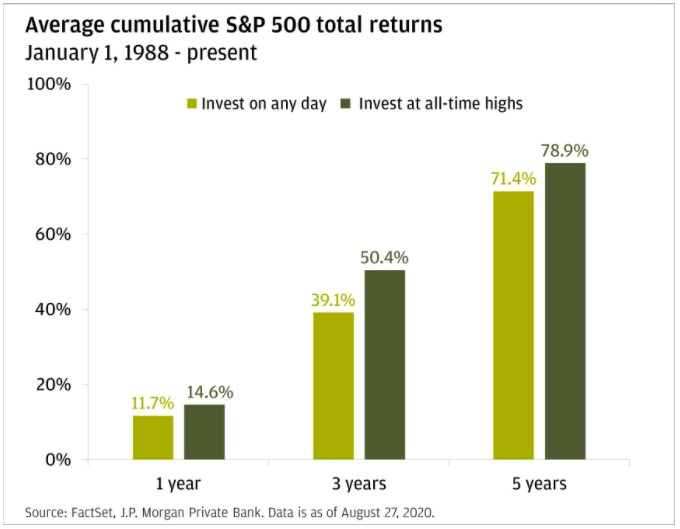

You can see from the chart below that investing at all-time highs of the S&P 500 between 1998 and 2020 has resulted in greater returns than investing on just any day.

History tells us that investing at market peaks works most of the time, as most of the time markets are going up and higher prices tend to continue to trend higher.

However, some of the time, a minority, this doesn’t work and the peak will be followed by a bear market.

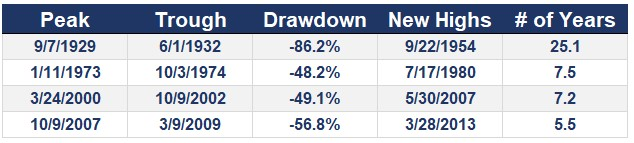

The length of the bear market is unknown and can take a while to recover, maybe many years.

The table below shows just how painful and long bear markets can be. But imagine waiting on the sidelines for decades at a time, that certainly doesn’t work.

Source: https://awealthofcommonsense.com/2020/12/investing-in-stocks-at-all-time-highs/

Having Humility as an Investor

What should you do, knowing that investing at all-time highs OR lows may not work out in your favour in the short-term?

Well… accept that it’s practically impossible to time market peaks and troughs. Having the humility to accept how risk assets and markets behave is essential.

It’s also important to have an appropriate asset allocation that will allow you to keep investing at all time highs, AND maintain the ability and flexibility to invest and stay invested after steep or sustained bear markets have others scared or unable to deploy capital.

Temperament is the most important skill required. Keeping a level head and buying things when they are at all time highs, instead of getting scared that the next crash is imminent and missing out on years worth of gains in a bull market.

You’ll also need to keep a level head when the more infrequent, but emotionally difficult, bear markets arise, instead of running for the exit.

YOUR Plan – Based on Your Circumstances

If you are a young investor with a secure income stream, having a higher exposure to riskier assets is fine, as you can continue to buy into a bad market with ongoing income.

If you are an investor with a large nest egg but limited time and working capital, it’s critical to have cash, to fund your lifestyle without having to sell your longer term holdings in down markets. And to be able to re-balance or buy these assets on sale.

You do not need to be the smartest investor to have the best outcome. What you need is a plan and the humility, temperament, and some knowledge of history for the ability to adapt and stay the course in all market environments.

Building and preserving wealth this way is time tested and inevitable, BUT it’s also very, very difficult, as our human nature is powerful and often wants to steer us off this course.

What I’m reading:

Articles

- 7 Differences between Smart and Wise People

https://medium.com/mind-cafe/7-differences-between-smart-and-wise-people-2dc74b385b69

“Intelligent people think they know everything. Wise people know how much they don’t know. Intelligent people are always certain of an answer.” – Ayodeji Awosika

- Two Things can be true at once

https://www.collaborativefund.com/blog/true-at-once/

As an investor, it’s important to be aware of the opposing forces that affect our decision making.

“It’s OK to have a plan while acknowledging you have no idea what the world will look like tomorrow. There’s a healthy zone between “prophet” and “fatalist.””

Books

- What Do You Care What Other People Think?: Further Adventures of a Curious Character – Richard P. Feynman, Ralph Leighton

I love this book, the storytelling is excellent and interesting. I love getting an inside look at the lives of interesting people.

Summary from Amazon

One of the greatest physicists of the twentieth century, Richard Feynman possessed an unquenchable thirst for adventure and an unparalleled ability to tell the stories of his life. What Do You Care What Other People Think? is Feynman’s last literary legacy, prepared with his friend and fellow drummer, Ralph Leighton.

Among the book’s many tales we meet Feynman’s first wife, Arlene, who taught him of love’s irreducible mystery as she lay dying in a hospital bed while he worked nearby on the atomic bomb at Los Alamos. We are also given a fascinating narrative of the investigation of the space shuttle Challenger’s explosion in 1986, and we relive the moment when Feynman revealed the disaster’s cause by an elegant experiment: dropping a ring of rubber into a glass of cold water and pulling it out, misshapen.