… And What Shopify’s Dramatic Drop in Stock Price Can Teach Us About Successful Investing

A great company does not equal a great investment: In other words, you can buy a great company at a high price that makes it a bad investment.

For example, Apple may be a great business, but buying at a certain price may not provide investors with good future expected returns.

Returns on shares in a business come from earnings, dividends, and multiple expansion or contraction (how much people are willing to pay for those expected earnings & dividends).

Companies with huge revenue growth can command higher multiples on earnings because investors are expecting the earnings of those businesses to continue and grow into the future.

Of course, that doesn’t always happen.

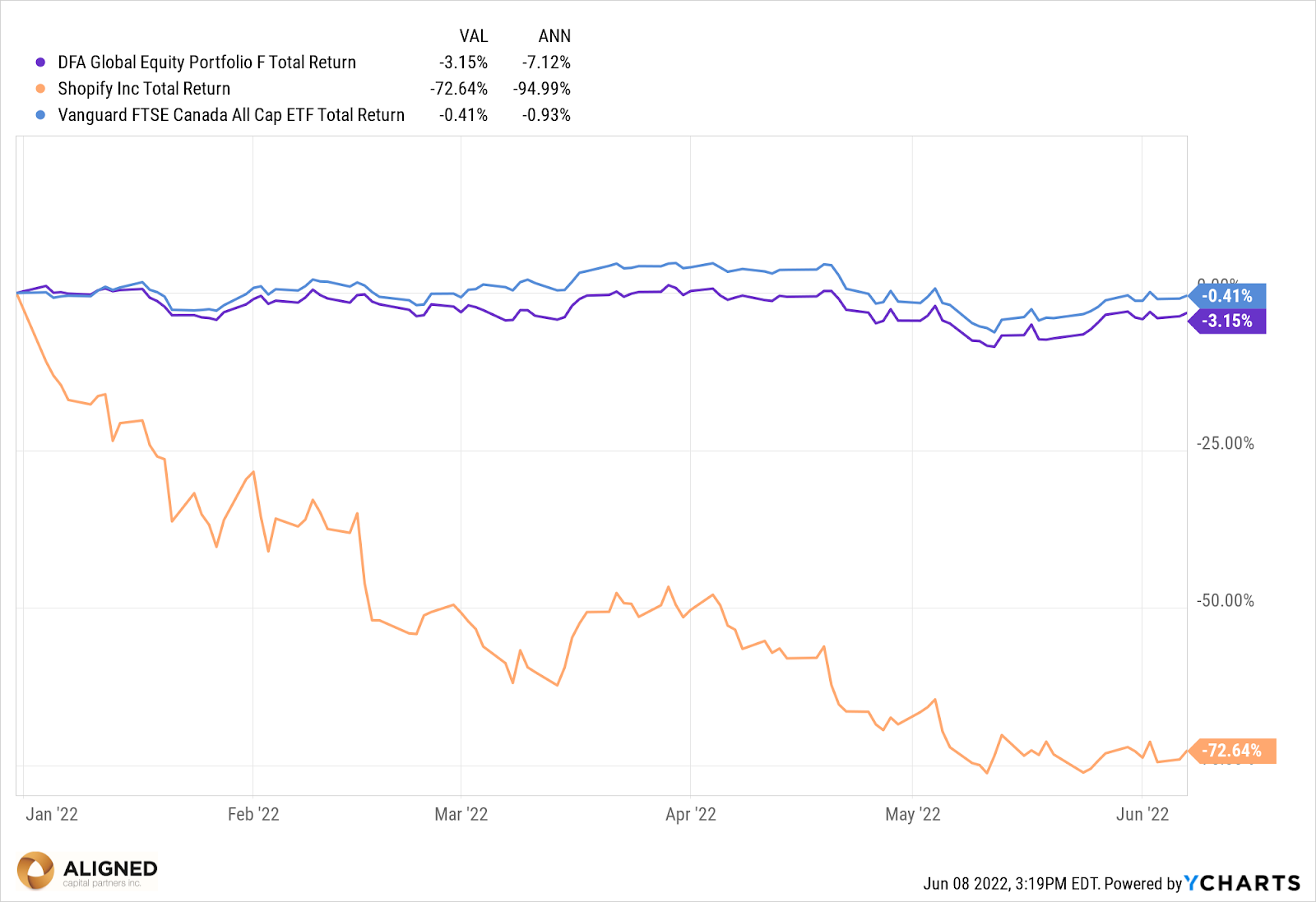

Take for instance Shopify. They’ve been in the headlines recently because of a pretty dramatic drop in their stock price between January 2022 and June 2022.

The stock price was based on high multiples of very optimistic expected revenue growth, and a future that would have to work out near perfectly for this company.

Shopify’s certainly not the only company that recently experienced a significant drop in stock price like this. Many fast growing companies see a rise in their stock price, often before they even start turning a profit.

Investors hope they’ll continue to grow into and exceed their speculative valuations.

The reality is that many companies don’t ever meet those high expectations.

I consider them almost like lottery tickets. You’ll have the odd winner, like Amazon, but there’s another 20,000 companies that don’t ever work out.

Even Amazon lost over 94% of its stock value from its high’s in 1999-2001. Source: Ycharts

There’s dozens of reasons that a seemingly successful, quickly growing company may not reach its speculative value:

- New competitors

- New technology

- Legislative changes that affect how they operate

- Worker unionisation

- Recession

- Change in interest rates

The list goes on.

I’m by no means advising you not to invest in Shopify because it still could be the next Amazon, but when you decide to invest in individual stocks, you have to do it in a way that doesn’t put you in a high risk situation.

“Lack of FOMO has to be one of the most important investing skills”

– Morgan Housel

When you see some of these technology or sector specific (i.e marijuana) companies’ stock prices or cryptocurrencies skyrocketing, it can feel like you’re missing out. The reality is that buying individual stocks will not work out for most investors.

What’s the solution?Rather than finding the needle in the haystack, buy the haystack – the haystack being the whole stock market. Somewhere in there are the future Amazon’s, Apple’s etc.

Core Portfolio vs. Shopify – Choosing a Smoother Ride

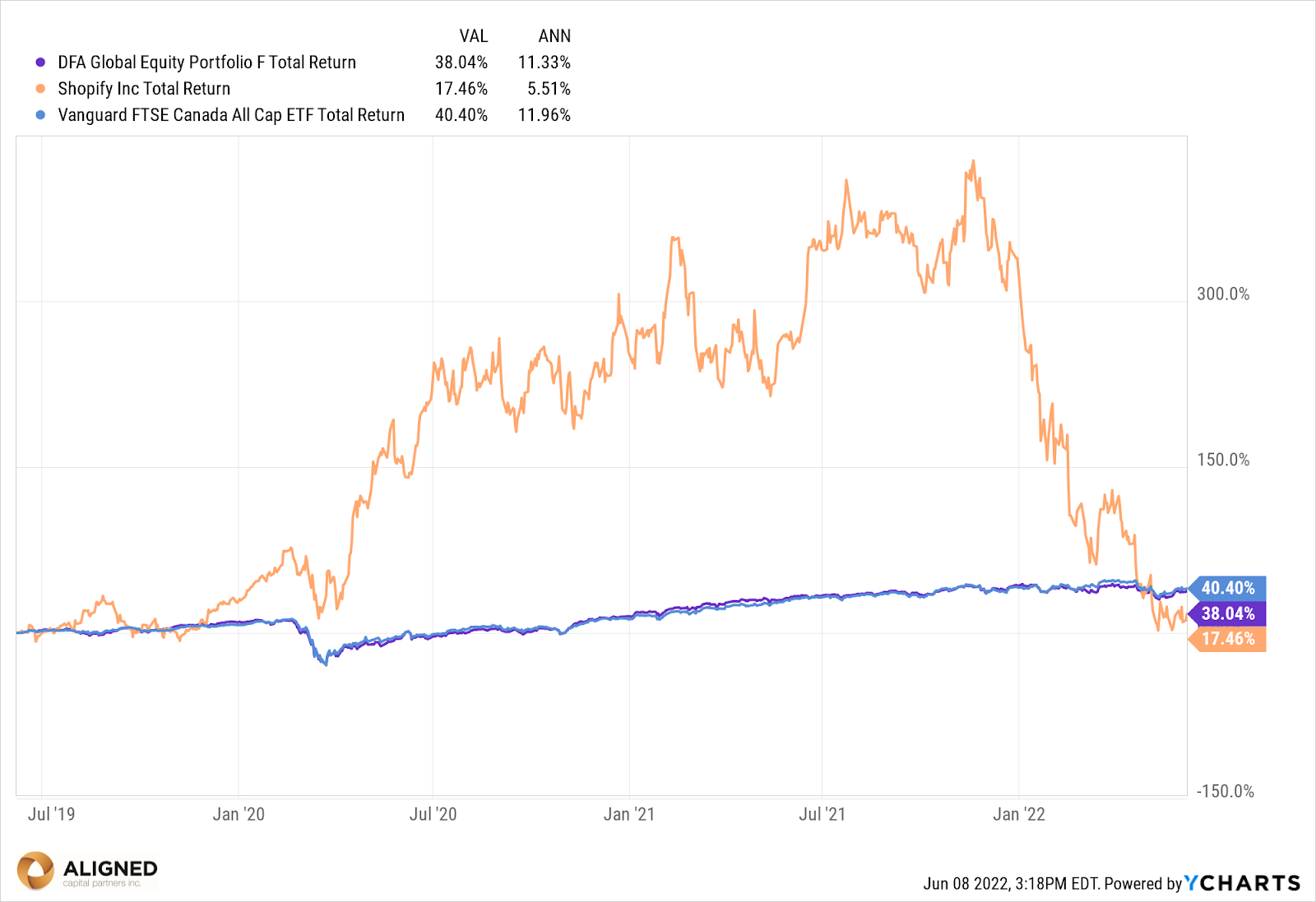

You can see from graph 1 (below), that if you had bought Shopify before 2019, your returns would be materially lower than our core equity portfolio. It would, however, be much more stressful to watch the value of your portfolio drop so much, and so quickly. What went up somewhat gradually, has come crashing down quickly.

When you choose a more diversified approach, you don’t need to check stock prices every day in a panic about your net worth or ability to reach future financial goals.

Amazon founder Jeff Bezos once asked Warren Buffett: “You’re the second richest guy in the world. Your investment thesis is so simple. Why don’t more people just copy you?” To which Buffett replied, “Because nobody wants to get rich slow.”

I can understand the interest and excitement in investing in individual stocks, you just have to do it in a way that doesn’t put you in a high-risk situation.

You can see from graph 2 (below) that if you had invested in Shopify in the very early days, most likely the founders and a small group of people, you would still be up 47% annualized, even after the drop. But even then, most people are buying more shares as they go and this distorts the returns. Their average price may still be lower even if they owned some from the beginning.

Point being, the odds of investing this early in a company that has massive success are incredibly low. By the time most investors pile into a stock, crypto, etc its because it’s already posted a big run.Remember that narrative follows price, not the other way around. See my recent post on recency bias for more on this.

Instead, setting up a portfolio like the core portfolio we use will be less stressful and lower risk. You’ll be able to reach your goals without the risk of utter ruin. Simply put, how much you save and invest (and not messing it up) is 99% of success.

Closing Thought

Some lessons you learned when you were a kid still hold true, in this case, The Tortoise and the Hare.

While the hare seemed like he was going to be the clear winner, you just never know where risk comes from. Risk is about uncertainty in the future and the future is always uncertain.

I’ll end with two quotes that sum up my thoughts on individual stock picking as an investment strategy:

“If you’re clinging on to growth stocks waiting for them to come back because that’s what standard financial advice says (Diamond hands/buy when there’s blood in the streets/etc)…you’re confusing the advice of owning beta [the broad stock market] and owning sectors/stocks/crypto/whatever”

– Ryan Kirlin

“I’d compare stock pickers to astrologers but I don’t want to bad mouth astrologers.”

– Eugene Fama

What I’m Reading

- How not to invest, on chasing returns:

https://www.morningstar.com/articles/1071658/ark- innovation-an-object-lesson- in-how-not-to-invest - Finding a strategy you can stick with:

https://www.collaborativefund.com/blog/keep-it-going/ - https://alphaarchitect.com/

2021/12/value-investing-what- history-says-about-five-year- periods-after-valuation-peaks/ - Why all of our behaviours are imitative, why we desire things we don’t need, and why this all leads to missing out on aspects of life that are far more meaningful and valuable:

https://fs.blog/knowledge-project-podcast/luke-burgis/

Disclaimer:

Marc Berger is an IIROC registered investment advisor with Aligned Capital Partners Inc. (ACPI), and as such, you may be dealing with more than one entity depending on the products or services offered. The name of the entity being represented should correspond to the business being conducted. ACPI is regulated by the Investment Industry Regulatory Organization of Canada (IIROC) and a Member of the Canadian Investor Protection Fund (CIPF). Securities are provided by ACPI.

This publication is for informational purposes only and shall not be construed to constitute any form of investment advice. The views expressed are those of the author and may not necessarily be those of ACPI. Opinions expressed are as of the date of this publication and are subject to change without notice and information has been compiled from sources believed to be reliable. This publication has been prepared for general circulation and without regard to the individual financial circumstances and objectives of persons who receive it. You should not act or rely on the information without seeking the advice of the appropriate professional.

Investment products are provided by ACPI and include, but are not limited to, mutual funds, stocks, and bonds. Non-securities related business includes, without limitation, fee-based financial planning services; estate and tax planning; tax return preparation services; advising in or selling any type of insurance product; any type of mortgage service. Accordingly, ACPI is not providing and does not supervise any of the above noted activities and you should not rely on ACPI for any review of any non-securities services provided by (Advisor Name).

Any investment products and services referred to herein are only available to investors in certain jurisdictions where they may be legally offered and to certain investors who are qualified according to the laws of the applicable jurisdiction. The information contained does not constitute an offer or solicitation to buy or sell any product or service.

Past performance is not indicative of future performance, future returns are not guaranteed, and a loss of principal may occur. Content may not be reproduced or copied by any means without the prior consent of the author and ACPI.

Disclosure of commissions in mutual funds in accordance with NI 81-102 (15): “Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. Mutual funds are not guaranteed, their values change frequently, and past performance may not be repeated.